Greece’s finance ministry on Wednesday announced a long-awaited draft bill that foresees the obligatory presence of POS machines – for use by consumers – in a handful of sectors that had up until now been exempted, such as taxis, outdoor fruit and vegetable stands and even insurance providers.

The initiative is part of the center-right Mitsotakis government’s efforts to clamp down on widespread tax evasion and avoidance in the east Mediterranean country, a long-standing scourge dramatically affecting state finances.

According to the draft legislation, beginning in early 2024 previously exempted businesses must possess a functioning POS device for transactions with consumers. Among others, cinemas, street-side kiosks, small single-owner grocery stores, concert venues and even brokerage firms, will have to field and operate POS devices – which must also be electronically connected with their cash registers, another step aimed to combat sales tax avoidance.

The draft legislation cites the obligatory presence of POS devices, not the mandatory use of only e-transactions.

The development comes on the back of an announcement by the finance ministry, according to which more than 221,000 self-employed professionals in the country – occupations ranging from civil engineers to craftsmen – show zero income on an annual basis or even losses.

The draft bill will be presented at the next Cabinet meeting by the finance ministry’s leadership for approval, before tabling in Parliament for ratification.

Uncollected sales taxes alone in Greece are calculated at 3.2 billion euros (17.8 percent of the total) for 2021, due to tax avoidance and fraud, according to a report by the European Commission. The report’s findings render the country in an unenviable third place in terms of sale tax losses, after Romania and Malta.

On a more positive note, according to the Commission, is the fact that the Greek state reduced sale tax losses by 3.2 percentage points year-to-year, as the figure stood at 21 percent of the total in 2020.

According to figures presented this week by National Economy and Finance Minister Kostis Hatzidakis, of roughly 676,000 personal tax codes issued to self-employed professionals in Greece, 37.2 percent declare zero income; 25.5 percent declare annual income of up to 5,000 euros, and only 20 percent declare income exceeding 10,900 euros – the annual tax-free ceiling.

“We’re not going to increase tax rates for the self-employed… the aim is a fairer system that will allow for…fiscal space, thus allowing an easing of the overall tax burden (for all taxpayers), in the long run,” Hatzidakis was quoted as saying.

Other announced measures are the mandatory use of the tax bureau’s e-bookkeeping platform (myDATA), along with specific and automatically filled-out fields on individual online income tax returns for revenues and expenditures.

Latest News

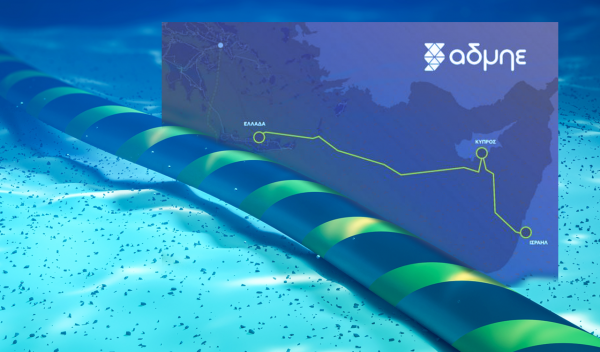

French Fund Meridiam Shows Growing Interest in Great Sea Interconnector

According to OT, the fund engaged in recent discussions regarding the Great Sea Interconnector with Greece’s Minister of Environment and Energy and the CEO of Greece’s Independent Power Transmission Operator (IPTO/ADMIE)

Everything to Know about Store Hours this Holiday Season

Stores and supermarkets across the country are operating extended hours, offering ample opportunities for holiday shopping

Greece Prepares for State Budget Vote as Debate Reaches Final Stages

Prime Minister Kyriakos Mitsotakis is expected to deliver his remarks late in the evening, shortly before the decisive vote that will conclude the session

DM Dendias: We talk With Turkey But We Always Bring Up Their Unacceptable Positions

Second and last day of closely watched conference, entitled 'Metapolitefsi 1974-2024: 50 Years of Greek Foreign Policy', also included appearances by PM Mitsotakis, Ex-PM Tsipras and PASOK leader Nikos Androulakis, among others

Rhodes Airport Tops Fraport Greece’s Regional Airports in 2024 Performance

According to Fraport's data, more than 35 million passengers (specifically 35.2 million) were handled by Fraport-managed airports during the 11 months.

European Central Bank Cuts Interest Rates by 25 Basis Points

It is the fourth cut of interest rates by Europe’s central bank, a move expected by the markets and financial analysts leading to the rate settling at 3%.

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

![Φυσικό αέριο: Δυναμικό come back του LNG στην Ελλάδα [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/01/OT_naturalgas-90x90.jpeg)

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433