Greece received a more-or-less early “Christmas present” on Thursday, as the European Central Bank (ECB) sent a “strong signal” by explicitly announcing that it could reinvest proceeds from its PEPP bond-buying scheme in Greek government bonds if the country needs support.

The wording, in fact, came from ECB President Christine Lagarde.

So far, the eurozone’s central bank has purchased roughly 35 billion euros worth of Greek state bonds under its debt-buyback scheme, which expires in March 2020.

Nevertheless, Greek debt is still excluded from the ECB’s older and continuing Asset Purchase Program due to a lower than investment grade rating.

“Greece has improved its ratings but does not have the rating that makes it eligible under the APP, and for this reason we have decided to have a specific reference to Greece and the Hellenic Bank,” Lagarde told reporters on Thursday.

“That’s a really strong signal, and it’s rare that we have a country-specific clause … That particular clause was very strongly supported in the governing council.”

Earlier, the European central bank said it could adjust PEPP re-investments in the event of renewed market fragmentation related to the COVID-19 pandemic, according to Reuters.

“This could include purchasing bonds issued by the Hellenic Republic over and above rollovers of redemptions in order to avoid an interruption of purchases in that jurisdiction which could impair the transmission of monetary policy to the Greek economy while it is still recovering from the fallout of the pandemic,” an ECB statement read.

Latest News

Greek PM Announces Sweeping Changes in 2025 State Budget

These measures aim to foster fairer banking practices and enhance the availability of affordable housing and credit

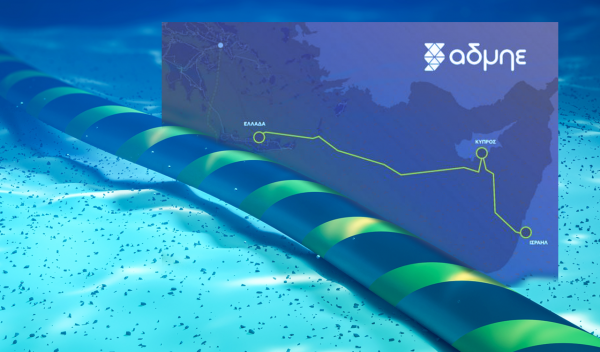

French Fund Meridiam Shows Growing Interest in Great Sea Interconnector

According to OT, the fund engaged in recent discussions regarding the Great Sea Interconnector with Greece’s Minister of Environment and Energy and the CEO of Greece’s Independent Power Transmission Operator (IPTO/ADMIE)

Everything to Know about Store Hours this Holiday Season

Stores and supermarkets across the country are operating extended hours, offering ample opportunities for holiday shopping

Greece Prepares for State Budget Vote as Debate Reaches Final Stages

Prime Minister Kyriakos Mitsotakis is expected to deliver his remarks late in the evening, shortly before the decisive vote that will conclude the session

DM Dendias: We talk With Turkey But We Always Bring Up Their Unacceptable Positions

Second and last day of closely watched conference, entitled 'Metapolitefsi 1974-2024: 50 Years of Greek Foreign Policy', also included appearances by PM Mitsotakis, Ex-PM Tsipras and PASOK leader Nikos Androulakis, among others

Rhodes Airport Tops Fraport Greece’s Regional Airports in 2024 Performance

According to Fraport's data, more than 35 million passengers (specifically 35.2 million) were handled by Fraport-managed airports during the 11 months.

European Central Bank Cuts Interest Rates by 25 Basis Points

It is the fourth cut of interest rates by Europe’s central bank, a move expected by the markets and financial analysts leading to the rate settling at 3%.

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

![Φυσικό αέριο: Δυναμικό come back του LNG στην Ελλάδα [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/01/OT_naturalgas-90x90.jpeg)

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433