Over the past decade, Greece’s tourism industry has flourished as the country’s attractiveness as a travel destination has remained high, while infrastructure has been greatly upgraded, according to a report by Alpha Bank’s Financial Studies Department entitled “Greek Tourism Industry Reloaded: Post – pandemic Rebound and Travel Megatrends ”.

The number of incoming tourists and travel receipts doubled between 2010-2019, as tourism around the world flourished, “absorbing” to some extent the shocks of the recessionary turmoil that followed the domestic debt crisis in 2010. However, the high dependence of the Greek economy on tourism, makes it vulnerable to external disturbances, such as the recent pandemic crisis.

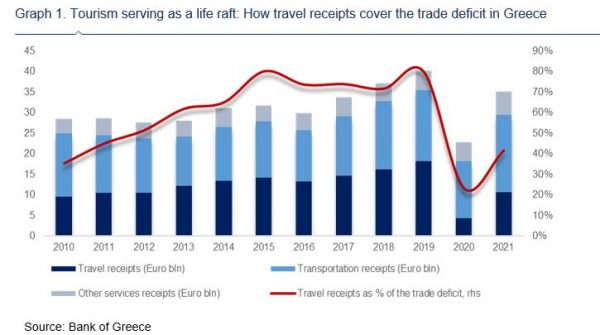

Prior to the pandemic, travel receipts accounted for a significant share of service exports (44%, on average, 2015-2019), mitigating to some extent the current account deficit, which in Greece is mainly due to the relatively high trade balance deficit. Travel receipts “covered”, on average, from 2015 to 2019, the trade deficit by 76%, which means that tourism was the main source of “financing” the trade deficit (Chart 1).

The intense tourist activity of the last decade, functioned essentially as a “lifeboat”, after partially absorbing the prolonged recession shock in Greece.

Undiminished upward influx of tourists

The almost undiminished upward influx of foreign tourists was the result of:

First, the effect of income of incoming tourists, which came mainly from the highest disposable income in real terms, and which is compatible with the upward trend of world GDP.

Secondly, the price effect, which came mainly from the reduced labor costs, as a result of the policy of internal devaluation implemented in the context of the rescue and economic adjustment plans, after the Greek debt crisis in 2010. The real effective exchange rate (REER ), which is an indicator of a country’s competitiveness relative to its main competitors, in terms of unit labor cost (ULC), has declined over the last decade. The decrease in the exchange rate, essentially reflects the strengthening of the country’s competitiveness, in the sense that labor costs in Greece were lower compared to the country’s trading partners. REER, in terms of Consumer Price Index (CPI), also decreased, between 2010 and 2019, indicating that prices in Greece were more competitive compared to this group of competing countries. Given that internationally traded “goods” such as tourism services are generally more exposed to international competition, it is considered that the price effect was even stronger in the tourism sector.

Third, the substitution effect, as external factors and events, resulted in attracting tourist flows from abroad and diverting market share from competitors. In particular, in the early 2000s, investment activity due to the preparation for the Athens Olympics facilitated the further expansion of the tourism industry, while in the following decade, geopolitical developments such as the Arab Spring and political instability in Turkey after the failed coup. led to a slight increase in Greece’s market share in arrivals from abroad, compared to its main competitors in the Mediterranean.

What doesn’t kill you makes you stronger

The main feature of the pandemic was the great demand shock, due to travel restrictions and other measures, which led to a sharp and large drop in tourist inflows. This led to a worsening of the current account deficit and thus to a significant loss of domestic product. This is an indication of the high dependence of the Greek economy on tourism. Specifically, in 2020, travel receipts represented only 19% of total service receipts and covered the trade deficit, by only 23%.

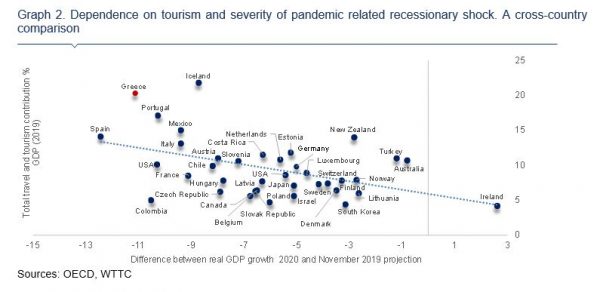

Thus, Greece suffered a deep recession shock in 2020, which significantly exceeded the OECD average, mainly due to its high dependence on tourism. Graph 2 illustrates the strong relationship between the degree of dependence on tourism and the magnitude of the recession shock. Countries that are heavily dependent on tourism, such as Greece, have suffered the most losses, in terms of domestic product. In Graph 2, the horizontal axis measures the loss in terms of GDP in OECD countries, which is calculated as the difference between the real GDP growth rates of 2020 of the selected countries and the corresponding OECD forecasts for November 2019. Essentially, it is a measure of the impact of the pandemic crisis on economic activity by country. The vertical axis shows the total contribution of tourism to GDP in 2019.

The countries with comparatively higher tourism contribution to GDP, suffered the largest losses of domestic product, in 2020. Specifically, the OECD forecast in November 2019 for the real GDP of Greece was an increase of 2.1% in 2020, while about a year later, the Greek economy recorded a 9% decline. This was attributed, among other factors, to the high overall contribution of tourism to the Greek economy, which is estimated at over 20% of GDP.

In 2021, the impressively high number of tourists who visited Greece during the summer months, contributed significantly to the strong GDP recovery (+ 8.3%). This development can be compared to the previous economic crisis, when tourism functioned as a “lifeboat” for the Greek economy. The influx of visitors and the revenue they generated, supported Greece’s economic recovery, to offset almost all of the damage suffered by GDP in the first year of the pandemic (2020: -9%).

Before the pandemic broke out, a changing landscape was emerging in the tourism industry worldwide. Customer preferences changed rapidly and businesses responded through a wide range of actions in specific areas: flexibility in booking and cancellation policies, digital branding, web searches, creativity and service diversification. Business models were already beginning to adapt to a demanding environment, but the pandemic accelerated tectonic changes in the economy that were expected to be implemented in the coming decades, especially with regard to digital technology. In addition, the need to combine a pleasant holiday experience with stricter health conditions and social distancing is likely to be a more permanent feature in the future, transforming the tourism sector.

The post-pandemic environment is also dominated by various megatrends, such as: (i) the expansion of the sharing economy, which increased price competition in the hospitality sector, leading to a further increase in tourist flows; (ii) the ‘green transition’ as an urgent need to tackle climate change and the environmental impact on many aspects of our lives, including travel and tourism; (iv) the new models of social distancing as a legacy of the pandemic; (v) the promotion of accessibility; (vi) the aging of the population and the adaptation of the tourism industry in order to develop, in parallel with demographic change and its effects, e.g. the change in demand for tourism services of different age groups and the emergence of new consumer patterns.

The new geopolitical instability and its effects

In the aftermath of the Russian invasion of Ukraine in February 2022, the expected strong tourism momentum in Greece is expected to slow down slightly, but is not expected to stop. The war between Russia and Ukraine is expected to affect the tourism sector through three channels.

First, through the absence of Russian tourists. This impact, however, is expected to be limited – given the low market share of Russian tourists in arrivals in Greece. Following the Crimean crisis in 2014, tourist inflows from Russia gradually decreased, mainly due to the devaluation of the ruble against the euro. At the same time, the market share of Russian arrivals in Turkey increased sharply, especially after 2017, as a result of the devaluation of the Turkish lira, reflecting, in part, a substitution effect (the corresponding share in Greece decreased). In 2019, Russian tourists accounted for 1.9% of total tourist arrivals in Greece, while the corresponding share for Ukraine was even smaller. The share of arrivals from Russia decreased to 0.3% in 2020, due to restrictive measures, recording only a marginal increase to 0.8% in 2021. In terms of travel receipts, the corresponding shares amounted to 2.4% in 2019 and at 1.1% in 2021.

Second, through the expected reduction in consumer purchasing power in the countries of origin (United Kingdom, Germany, Italy, France, Romania, USA, etc.) as a consequence of rising energy prices. This is expected to lead to a possible slowdown in tourist arrivals – given their positive GDP per capita, as shown in Graph 3b- and, consequently, of travel receipts. However, this impact can be partially offset by the accumulated savings during the pandemic and the tendency for increased consumption in the post-pandemic period.

Third, through higher operating costs, due to sharp increases in energy prices that reduce the profit margins of tourism companies.

Latest News

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

Lloyd’s List Greek Shipping Awards 2024: Honors for leading companies and personalities in the Greek shipping sector

20 awards presented at the 21st annual Lloyd's List Greek Shipping Awards

![Χειμερινή εξοχική κατοικία: Οι Ελληνες γυρνούν την πλάτη παρά την πτώση των τιμών [γραφήματα]](https://www.ot.gr/wp-content/uploads/2024/12/Capture-19-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433