Russia’s latest “game” with natural gas is causing serious turmoil in the Greek stock market, which is currently moving with significant losses. In particular, the general index is falling by 1.55% to 924.35 points, with a turnover of more than 15 million euros.

At a time when Greece is in the market for the reissue of its seven-year bond issued in 2020, the government will have to deal with Russia’s threat to cut off gas supplies to those countries that refuse to pay in rubles. Greece has a deadline of less than 30 days, according to information from ot.gr, in order for DEPA Emporia, the largest importer of Russian physics in the country, to pay the planned installment for the receipt of quantities of fuel from Gazprom.

And all this while the Greek State is in the markets, a day when the yields of Greek securities have increased. In fact, after yesterday’s announcement of the exit from ODDIH, the Greek ten-year bond increased to 3.11%. Greek borrowing costs had started to rise since October 2021. The ten-year bond had risen to 1.338%, from the level of 0.847 in September 2021. After the Russian invasion of Ukraine the yield is close to 2.5%.

At the level of securities, the focus of the pressures is Piraeus Bank, Viohalco, Alpha Bank, Coca Cola, IPTO, Lambda, PPC, Mytilineos, Terna Energy, Jumbo, GEK Terna and Aegean, as they record losses that exceed 2%, while National Bank, OTE and Hellenic Petroleum are trying to control pressure.

Latest News

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

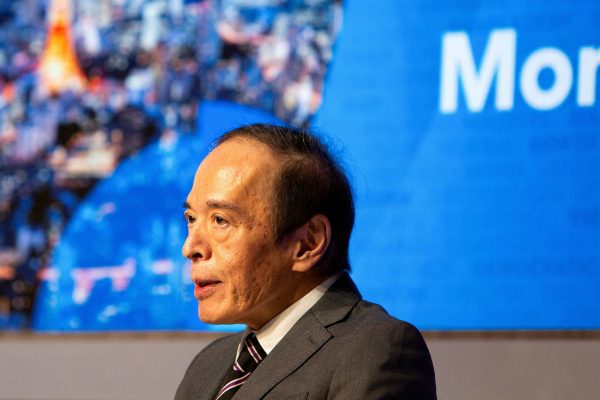

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

Lloyd’s List Greek Shipping Awards 2024: Honors for leading companies and personalities in the Greek shipping sector

20 awards presented at the 21st annual Lloyd's List Greek Shipping Awards

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433