The Hellenic Financial Stability Fund (HFSF) on Wednesday announced the completion of an updated process for its divestment strategy in a press release.

According to the statement, “…All interested parties are in agreement and it has been approved by the Ministry of Finance…

The Divestment Strategy adheres to the principles defined in the legal framework governing the operation of the HFSF as well as all relevant legal and regulatory provisions. The current HFSF legal framework elevates the divestment objective to a par with the Fund’s other objective, namely its contribution to the maintenance of Greek banking system financial stability for the sake of public interest and sets year-end 2025, the Fund’s sunset date, as the timeline of its completion.

The Fund will expend all reasonable efforts to dispose of all its shares in the Greek systemic banks before its sunset date, in an orderly manner, in line with its objective to maintain financial stability while ensuring market that it receives fair value.

The sale of shares in any of the Greek systemic banks is fully consistent with the HFSF’s responsibility to promote financial stability and reflects the progress of the banking sector in addressing past weaknesses and achieving sustainable profitability.

The divestment of the Fund’s holdings will also provide important benefits to the Greek economy as a whole by increasing the free float of the Greek banks that should further boost the Greek capital markets’ liquidity and efficiency, by providing more opportunities for foreign direct investment in the Greek banking sector at scale and by demonstrating pro-actively the progress towards re-establishing a banking sector under fully private ownership.

The HSFS will identify opportunities to initiate and execute well-designed transactions that monetise its portfolio in the most advantageous way always in compliance with the entirety of its legal framework. It will also consider any unsolicited approaches it receives and any proposals that may be put forward by the banks.

In deciding whether a sale of shares should be pursued, the HSFS will take into account its financial stability obligations as well as the fairness of the value offered for its holdings. In any case, when executing transactions, the HSFS will follow a transparent and competitive process while maintaining confidentiality as appropriate for the specific transaction.”

The entire press release is here:

Latest News

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

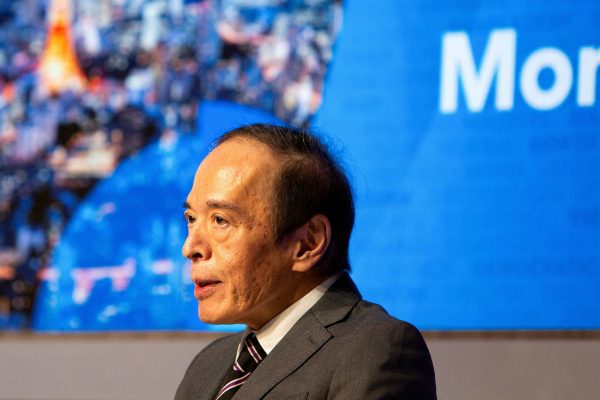

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

Lloyd’s List Greek Shipping Awards 2024: Honors for leading companies and personalities in the Greek shipping sector

20 awards presented at the 21st annual Lloyd's List Greek Shipping Awards

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433