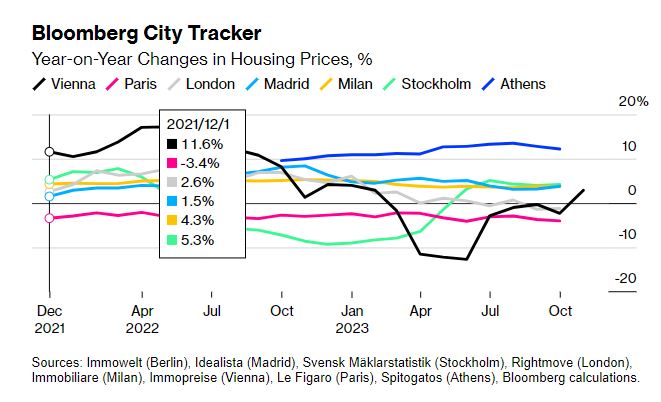

House prices in Greece are “running” at the fastest pace in Europe. The rapid increase in prices in Greece has caused a great impression and disturbance to the interested public, as the cost of real estate far exceeds the budget of the average Greek household.

According to a Bloomberg analysis, the increase in real estate prices is a Greek phenomenon. The rise is partly due to the effects of the Greek debt crisis which are affecting supply. In Athens, property prices rose by 12.2% in October, while in Paris and Stockholm, prices fell.

London, Paris and Berlin saw year-on-year declines in their latest monthly figures, however, most of the markets tracked by Bloomberg City Tracker are growing, with Milan, Madrid and Stockholm posting increases of more than 3 %.

Athens prices come from a Spitogatos index, which Bloomberg used to calculate monthly asking prices in the city’s five districts and then averaged those to calculate citywide prices.

“There are no properties on the market,” said Lefteris Potamianos, president of the Athens-Attica Real Estate Association, who also attributed the rise in prices to demand fueled by the Golden Visa program.

Athens has become one of the most sought-after real estate markets, with “forgotten” or run-down areas being “revived” and coming on an equal footing with pricey European cities.

Thus, areas such as Gazi have turned into a sought-after neighborhood, while in Glyfada, luxury complexes are being built aimed at wealthy investors from abroad, especially from China.

In Ellinikon, the redevelopment of the old airport will include approximately 10,000 luxury beachfront homes and apartments upon completion in 2026.

The real estate rally

The prices of apartments (in nominal terms) increased in the second quarter of 2023 by 13.9% on an annual basis, compared to an increase of 11.8% in 2022, according to the financial stability report published by the Bank of Greece.

The prices of new apartments (up to 5 years old) in the second quarter of 2023 increased at an average annual rate of 13.8%, while the prices of old apartments by 14.1%.

In the short term, it is estimated that investment interest, mainly from abroad, will remain intense especially for specific privileged positions in the Attica basin and for areas with tourist characteristics.

In the medium term, initiatives related to supporting specific categories of households (e.g. youth, vulnerable social groups) through the “My Home” program for the acquisition of housing are expected to contribute to stimulating demand, while corresponding initiatives to renovate old housing (e.g. .eg “Renovate” – “Save” program) are expected to contribute to the improvement of the building stock.

However, it is pointed out that the residential real estate market in many countries of the European Union is already undergoing a significant correction in terms of the number of transactions, prices and yields.

Still far from the all-time high

In addition, it is reported that house prices in Greece are still far from the historic high recorded before the financial crisis.

Based on the apartment price index compiled by the Bank of Greece for the entire country, the highest value of the index was observed in 2008 (101.7) and then followed a steady downward trend, to record the lowest value in 2017 (59 ). Since then, the apartment price index has been on a steady upward trajectory, reaching 90.6 in Q2 2023, down 11.1% from its all-time high.

The evolution of the level of rents is similar, with the relative index being 98.5 based on the data of the third quarter of 2023, against 94.8 in the fourth quarter of 2022.

The rent index, unlike the housing price index, remains significantly lower than the highest value it has reached historically (124.3, Q3 2011).

Latest News

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

Lloyd’s List Greek Shipping Awards 2024: Honors for leading companies and personalities in the Greek shipping sector

20 awards presented at the 21st annual Lloyd's List Greek Shipping Awards

Syria’s Bashar al-Assad, His family Granted Asylum by Russia

Reuters also reported that a deal has been struck to ensure the safety of Russian military bases in the war-ravaged country

Greece to Introduce Artificial Intelligence into Its Education System

Currently, Greece is taking its first steps to bring AI into classrooms through the AI4edu program, which is being co-funded by the European Union

![Χειμερινή εξοχική κατοικία: Οι Ελληνες γυρνούν την πλάτη παρά την πτώση των τιμών [γραφήματα]](https://www.ot.gr/wp-content/uploads/2024/12/Capture-19-90x90.jpg)

![Χειμερινή εξοχική κατοικία: Οι Ελληνες γυρνούν την πλάτη παρά την πτώση των τιμών [γραφήματα]](https://www.ot.gr/wp-content/uploads/2024/12/Capture-19-600x294.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433