The first quarter of 2022 will be crucial for the course of the index of non-performing exposures of banks, as loans totaling 11.4 billion euros are coming out of the state support programs.

In addition to the macroeconomic turmoil of the pandemic that has inevitably led to a reduction in the incomes of many borrowers, additional pressures have been exerted since last September by inflationary processes.

And it seems that energy prices will remain high for at least a few more months after the Russian invasion of Ukraine.

In this context, the administrations of banks and debt management companies have already sounded the alarm about the aforementioned loans, as there are concerns about whether borrowers will be able to service their debts after the end of the grants.

The two subsidy actions

We are talking about the actions “GEFYRA 1” and “GEFYRA 2”, through which natural persons with loans connected to their main residence and companies respectively, secured a state subsidy for their installments.

In more detail:

– GEFYRA 1 supported 82,000 individuals with mortgages totaling 6 billion euros, for a period of 12 months after the 3-month extension of the aid.

The majority of these loans have completed the projected grant period at the end of 2021 and now borrowers will have to pay 100% of the installments.

– GEFYRA 2 concerns 13,000 legal entities with exposures of 5.4 billion euros, which secured a subsidy for their loan for 8 months, with amounts up to 80% of the installment.

All these loans will leave the grant status by the end of the first quarter.

Close monitoring

According to Ms. Fotini Ioannou, General Manager of Corporate and Retail Banking Receivables Management of the National Bank, “the geopolitical crisis could not have been predicted”.

Speaking at the recent FIN FORUM 2022 conference of the Bank of Greece, she said rising inflation and energy costs were likely to affect growth, possibly affecting household disposable income, which could lead to a new generation of red loans. ».

However, she stressed that it remains to be seen how the loans coming out of the support programs will behave, after the first quarter of 2022.

At present, according to her, there is no worrying early indication “that leads us to believe that we will have new flows of non-performing exposures. However, close monitoring is needed. ”

Banking sources say they are moderately optimistic about these exposures. Their point of view is based on two parameters:

First, there is a strong incentive for borrowers to default on their payments for a period of up to 18 months, depending on the situation in which their debt was before joining the GEFYRA program.

If someone misses even two installments during this period, all the help they received will be requested back. Therefore, they estimate that there will be no strategic defaulters, due to the high costs involved in blushing the loan.

Secondly, the majority of these loans have remained green in the past, despite the conditions prevailing due to the economic crisis in our country. Therefore, they have proved in practice that they are overcoming difficulties.

The new bankruptcy code

Otherwise, the wager is on the smooth operation of the new out-of-court debt settlement mechanism for banks, through which non-performing loans can be repaid.

According to Ms. Ioannou, to date, 48 thousand applications have been submitted, which are active and concern debts to banks and the State, of almost 16 billion euros. “These are applications that we need to process and find solutions,” she stressed.

She also referred to the body for the recovery of vulnerable households, which, as he said, “we must see how and when it will work”.

It is recalled that a few days ago it was announced the suspension of auctions for this category of borrowers for 15 months, ie until the establishment of the new body. During this period, in fact, they will receive a monthly housing allowance that can reach up to 210 euros.

However, in order to ensure the protection, they have to pay their own participation in the amount that will be set and which will correspond to the rent that they would pay if they rented their property.

When the institution operates, it will acquire their home and the borrowers can stay in it as tenants for up to 12 years if they wish. They will then have the right to buy it at the commercial value it will have at that time.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

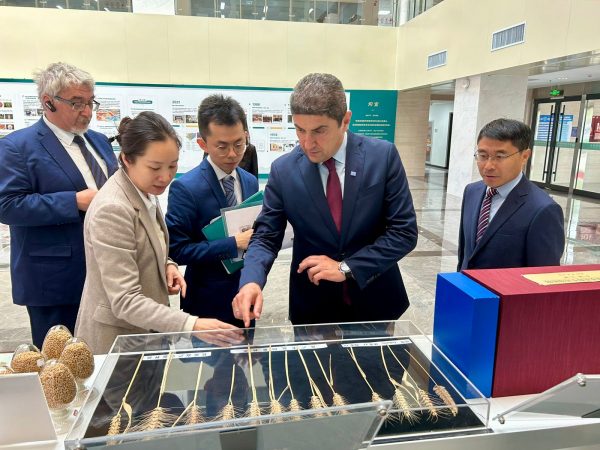

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433