In light of foreign direct investment in Greece for 2021 exceeding €5 billion – the largest inflow of foreign capital since 2002, we asked Andreas Yannopoulos for comments. Mr. Yannopoulos has a background in both international business and public service, and is the founder of the InvestGR Forum: Foreign Investment in Greece, an annual event now going into its fifth year.

Mr. Yannopoulos, with 2021 a banner year for FDI in Greece, breaking the €5 billion mark, in your opinion, what are the main factors contributing to Greece’s improved performance as an investment destination?

The ongoing reform efforts of the last several years have clearly played a large part in improving the business climate and giving international investors confidence in Greece. At the same time, the country is showing all signs of significant economic growth, while asset prices are still quite low, as an after effect of the debt crisis – a winning combination from an investor viewpoint.

We are also seeing increasing diversification the Greek economy, which is opening up new investment and business opportunities. Greek tech and innovation is rising, with the first Greek unicorn emerging early this year, as one example. The Green Deal is not only spurring investment directly in RES, a relatively new sector for Greece, but also has a multiplier effect. In the EY attractiveness survey for 2021, which was presented at our Forum last year, 74% of investors polled cited Greek environmental policies as a significant reason to invest in Greece.

And lastly, I would like to point out that, when we started the InvestGR Forum five years ago, foreign direct investment was still a somewhat controversial subject in Greek public discourse. In other words, people were still discussing whether foreign investment was even desirable. That is not the case anymore. There is, correctly, discussion about what kind of foreign investment is optimal for the country, for example, but the starting assumption, at home and abroad, is now that Greece is an active partner in the global economy.

Which sectors do you see as emerging investment sectors of particular interest in Greece?

Green energy, and related technologies, infrastructure and services, is definitely a sector that is already active and likely to accelerate further, especially with the funds earmarked in Greece 2.0.

One sector that has enormous growth potential is in the life sciences sector. We are already seeing a lot of activity in pharmaceuticals and health care. The pandemic as well as the ageing population of Europe have put greater focus on this sector. Greece has a well-established pharmaceutical industry already, and the human resources to support further growth in this area. But investors are also looking at diagnostic centers, hospitals, health insurance and startups producing health-related apps. Even in 2020, when FDI was depressed globally, the Greek pharmaceutical sector tripled its FDI. More generally, Greece and the Greek lifestyle is associated with health and wellness and it is easy to imagine future synergies between Greece’s life sciences sector, the Silver Economy and medical tourism.

In all these sectors innovation also plays a significant role, and international companies are increasingly recognizing the advantages of having research hubs in Greece. This is likely to expand to other areas as well.

You bring policy makers and business leaders together at the Forum to discuss ways to further enhance the business climate in Greece, among other issues. Of the reforms of the last few years, which do you think have been especially important in that regard?

Before mentioning specific reforms, I think it is worth noting that there has been greater coordination and focus at the policy level in the last few years. This leads to reforms, large and small, being relevant and effective.

But I think the roll-out of e-government, accomplished during the pandemic, will have wide and lasting positive effects for the economy. It also reinforces the message that the government is committed to cutting red tape and unnecessary bureaucracy.

The recent tax cuts, both of corporate tax and payroll taxes, are obviously welcomed by the business community, whether local or international.

More recently, the new omnibus investment law just passed, which aims to streamline the project development process, and has the potential to spur more investment, both foreign and domestic.

With COVID a continuing concern and the current situation in Ukraine, what do you think the impact will be for the Greek economy?

I am not an oracle. If there is one thing we have learned in the last two years, it is that the future is always unpredictable and that we must always be ready to adapt to current circumstances. We come out of this phase of the pandemic with our export sector intact and setting a new record in 2021, and with new digital capabilities. This includes vastly expanded e-commerce, e-government services and digital tools having been adopted widely in both the public and private sector. Going forward this is an added strength.

As far as the situation in Ukraine, the most immediate impact for the economy is the effects in the energy market, which will weigh on world economic growth and lead to higher inflation. But the volatility in the energy markets may also spur further energy diversification in Europe and also further the adoption of renewable energy technologies. In the short term, an economic slowdown worldwide will hurt the Greek economy. But over the medium term, Greece may stand to benefit from a changing energy landscape.

Greece is developing as an energy hub for Southeast Europe and the country is moving ahead quickly with adopting renewable energy technologies. As an energy hub, new natural gas facilities and pipelines are being developed in northern Greece, while new high voltage undersea power cables are being planned to link Greece with Cyprus, Israel and Egypt.

With respect to renewable energy, we have seen a lot of investment in new wind and solar facilities in the last two years, as well investments made in related infrastructure, like the extension of the national power grid to Crete and the Aegean Islands. One of the big next steps will be when a new regulatory framework is in place to develop offshore windfarms, something that is expected this year.

In the meantime, the fundamentals of the Greek economy are healthy at this point, and both the public and private sectors have become more agile during COVID. So I would say we have grounds for guarded optimism, in spite of the challenges.

Latest News

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

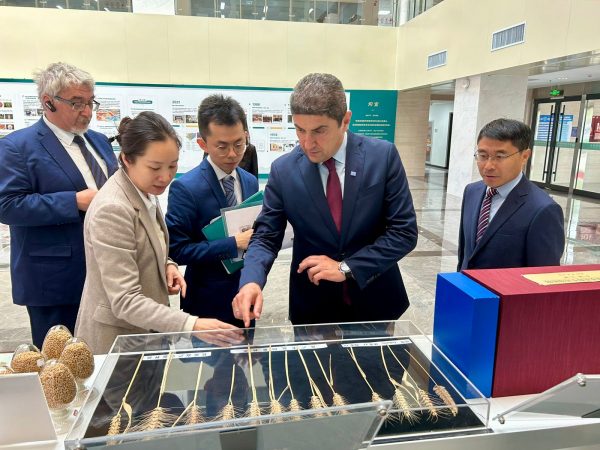

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Greek PM Mitsotakis Says Fight Against Inflation Ongoing

The Premier made statement during a visit an an open vegetable market

Unpaid Taxes in Greece Reach 1.539bln Euros

As the figures revealed the number of debtors totaled 3,878,712 individuals and legal entities.

ELSTAT: Greek Primary Surplus Reaches 1.9% of GDP in 2023

Greek debt saw a slight dip to 356.7 billion euros by the end of 2023, down from 356.8 billion euros a year prior

![Φυσικό αέριο: Γιατί είναι δύσκολη η απεξάρτηση από τη Ρωσία – Τα εμπόδια [Χάρτης]](https://www.ot.gr/wp-content/uploads/2022/07/gas-1-1-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433