2022 was not a very good year for the Greek dairy market and especially for yogurt, with sales declining significantly compared to 2021.

The increased household expenses for the service of fixed expenses, ie utility bills, loan servicing, rents and gasoline, the wave of price increases on the supermarket shelves, but also the lack of last year’s purchases, panic over the lockdown, have cut down turnover of even basic food items, such as dairy, say retailers.

Read also: Agno milk again on supermarket shelves: Sarantis brothers’ plans for the factory

According to data from NielsenIQ measurements, in the first two months of 2022, sales of yogurt show a decrease of 7.2% compared to the corresponding period of 2021, while in milk the decrease is 5.1%.

214 million euro market

The downward trend this year is a continuation of the declining sales recorded in 2021.

Based on the data from the market measurement carried out by IRI, for the year ending December 31, 2021, the Greek yogurt market, excluding sales for traditional yogurt (s.s. that with the characteristic “skin” on the surface area) was around 54,700 metric tons in volume and around 214 million euros in value.

In 2020, during the pandemic the quantities sold were higher (56,175 tons), while in 2019 the sales volume was a total of 55,005 tons. Respectively, sales in value in 2020 were 222 million euros, while in 2019 it was 219 million euros.

Read also: FAGE: The saga of a factory and the price of milk

It should be noted that yogurt is traditionally a key element of the Greek diet, while in contrast to other countries where yogurt is usually only a dessert or breakfast product, in Greece it is mainly consumed as a standalone snack or as part of a meal.

The competition and the “private label” player

The Greek yogurt market is very competitive with the big players resorting to aggressive pricing policy, in order to keep their shares intact.

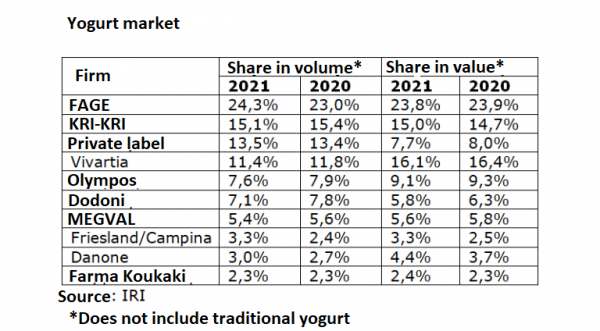

Even FAGE, which maintains the first place in terms of sales in volume and value, increased the offers to keep its position at the top. It is characteristic that the company of the Filippou family in 2021 has a higher share of sales in volume (24.3%) than sales in value (23.8%).

The second player in the industry, the Serrais dairy Kri-Kri, has increased its share in both volume and value, however, as it states in the financial statements for 2021, the increase in sales will not be easy this year, “as the overall market of yogurt in Greece seems weak and is declining in the first months of 2022 “.

In terms of sales value, the second place is occupied by Vivartia (DELTA) with 16.1%, with Kri-Kri in third place (market share 15%), followed by Olympus with 9.1%, the private label with 7.7%, Dodoni with 5.8%, Mevgal with 5.6%, Danone with 4.4%, Friesland / Campina with 3.3% and Koukaki Farm with 2.4 %.

It is interesting that the third largest player in the quantities of yogurt sold in Greece are the “anonymous” products (private label) that are essentially prepared by the large dairies on behalf of the supermarkets.

Latest News

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-600x375.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433