The National Bank of Greece group reported an increase, by 42 percent, in after-tax profits for the first quarter of the year, reaching 578 million euros.

NII increases were up 6 percent, yoy, reaching €294m on the back of funding cost benefits from time deposit re-pricing and the TLTRO facility, offsetting NPE NII reduction due to clean-up.

NPE reduction continued in 1Q21, with the stock of domestic NPEs down by €0.2b qoq to €4.1b, reflecting organic actions. Following the expiry of all of our moratoria by YE20, payment performance remains encouraging, as less than 7% of our clients that used moratoria are in early arrears (>30dpd) and c50% (€ terms) are low risk customers that have not requested further payment assistance, while transitions to the NPE perimeter are immaterial.

Despite the sustained lockdown in 1Q21, fees were up by 1% yoy to €67m.

Sharp cost cutting in Greece (-9% yoy), driven by the impressive reduction in personnel expenses (-17% yoy); C:CI improves sharply by 9ppts yoy to 52.1% in 1Q21.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

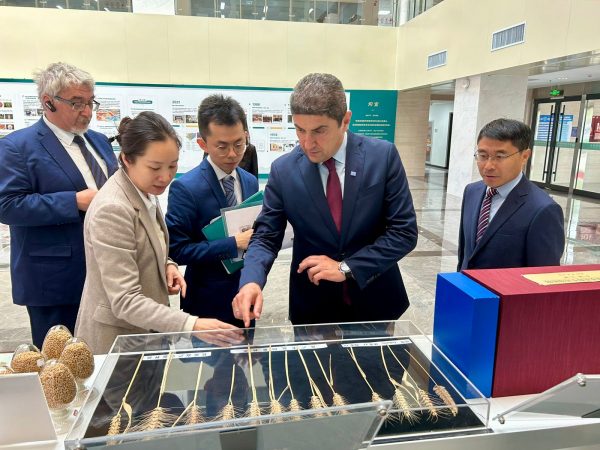

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433