By Eleftherios Charalampopoulos

Part One

The bankruptcy and subsequent restructuring in 2018 of Aegean Marine Petroleum Network –AMPNI (“Aegean”), a company founded by Dimitris Melissanidis, and in which he was the primary shareholder up until 2016, has opened the way for lawsuits by the company’s creditors.

One of the lawsuits has been filed in a Luxembourg court and lists Melissanidis, his son Georgios, the Luxembourg-based company Grady Properties Corporation SA, Leveret International S.A., Oil Tank Engineering and Consulting Ltd (“ΟΤΕ”) and two liquidators of Leveret as defendants.

The lawsuit was filed by the Aegean Litigation Trust, which was established as part of the restructuring process following an order by a relevant US bankruptcy court, with the purpose for the purpose of pursuing claims of Aegean for the benefit of Aegean’s creditors. AMPNI, AOTC, AMP SA and AMP LLC have transferred their Litigation Claims to the Trust.

The crux of the case is plaintiffs’ assertion that the defendants committed widespread fraud and on the basis of this their claim is 318.863. 434 USD (EUR 283.864.983).

According to the lawsuit, Melissanidis “had abused his dominant position within Aegean fraudulently to syphon funds away from Aegean to entities he controlled or in which he had a direct interest, often using OTE as a conduit.”

Parallel legal actions in Cyprus and the Marshall Islands

According to the lawsuit, after a petition by the Trust “…On 9 July 2020 {…} Cyprus court issued an injunction freezing approximately $106 million of Dimitris Melissanidis’s assets and $6.2m of Georgios Melissanidis and Grady’s assets in Cyprus in support of these proceedings.{…} The judgment of the Cyprus Court is under appeal.”

Because OTE is incorporated in the Republic of the Marshall Islands (RMI), “…In August 2019, the Trustee applied for an order appointing a receiver over the business of RMI. The RMI court made that order on 8 August 2019 and continued the order on 13 July 202031. These orders divested management control of OTE from its directors, and placed an independent officer of the court in control of OTE.”

Construction of a terminal station in Fujairah

The plaintiffs also assert that, beginning in 2010 and until 2014, Melissanidis exploited the construction of the Fujairah Terminal to pay $123 million of Aegean funds improperly to OTE, and to simultaneously conceal his personal profit from the construction project.

The specific company (OTE) was established in the Marshall Islands in 2010. Its shareholder from 2013 to 2015 is identified as Anastasios Tyros, followed by Aimilios Vrachypedis from 2015 to 2017, and Mara Giogaki from 2017 until today.

Melissanidis claims that OTE is an independent business that belongs to its shareholders, and which did, indeed, provide the services cited, and was an intermediary in the settlement of Aegean debts to various third parties.

Plaintiffs also maintain that although OTE presented itself as a company that was not linked to Melissanidis and Aegean, nevertheless “…evidence shows that, in essence, OTE was merely a corporate structure used by Dimitris Melisanidis to engage in illegal transactions with Aegean for his own personal benefit.”

All three of the individuals that successively appeared as the OTE shareholders were employees of Aegean or of companies controlled by Melisssanidis. OTE has no other commercial activities except those involving Aegean, and it appears the company was established exclusively for the construction of the terminal station in Fujairah. In fact, one email sent to Aegean employee Apostolos Rizakos, dated 31 October 2013, by Tyros, reportedly states the following: “I will stop being paid through Oiltank [OTE] and I will start receiving my salary from Aegean, as instructed by Mr. Melissanidis”.

The lawsuit also states that “…Mr. Tyros and Mr. Vrachypedis also required the approval of “Mr D.M.” before OTE made certain payments, which they would not have needed if they beneficially owned the company”.

When consulting services cost more than construction of the project itself

The lawsuit also states that “…On 31 March 2010, AOTC (acting through its director Dimitris Melissanidis) and OTE (acting through its director, and then AOTC employee, Mr. Tyros) entered the Fujairah Terminal Contract). Pursuant to the Fujairah Terminal Contract, OTE would provide to AOTC ‘design, project management, supervision and other relevant consultancy services and procurement of equipment’ in relation to the construction of the Fujairah Terminal”. At the time, AOTC was fully owned (100 percent) by Melissanidis, and was not yet a subsidiary of Aegean. On 7 November 2012 AOTC and OTE entered the Amended Fujairah Terminal Contract, increasing the amount to be paid by AOTC to OTE from $26,825,000 to $123,375,000.

In December 2010 AOTC entered a contract worth 74 million USD with the construction company Quality International Co. Ltd, which is based in the UAE. The total cost of construction of the terminal station was 226,067,000 USD, of which 83 million USD when to Quality International; 16,631,000 USD were financing costs and 123,378,586.56 USD were payments to OTE, based on what was announced by the Aegean group.

Again, according to the lawsuit, Melissanidis claims that Tyros was an experienced engineer; that Aegean wanted a contract with him for managing the construction of the terminal station, and that Tyros incorporated OTE to provide these services. It’s also claimed that Melissanidis could not have had participation in decisions for the terminal station at Fujairah. Melissanidis’ side appears to also claim that 16.2 million USD was, indeed, paid to OTE, and cites a valuation of the terminal station of 189 million USD.

Vrachypedis appears to claim that construction costs eventually reached 114 million USD.

The plaintiffs insist that Melissanidis had signed the amended contract between AOTC and OTE. This contract cited 123 million USD, of which 57,929,237 USD went for consultative services and the management of equipment, at a time when the actual construction firm received 83 million USD; in other words, it was agreed that 54 percent of the cost would be funneled to OTE. According to the plaintiffs, the “…The sums of money that Aegean agreed to pay OTE in the Amended Fujairah Terminal Contract were staggering. This is in itself a badge of fraud.”

Additionally, there are indications, according to the plaintiffs, of over-charging. The project included 1,250,000 USD for fire-fighting pumps, with relevant invoices from the US company that supplied them. However, despite the fact that the US company did not supply additional pumps, multiple invoices appeared. This means that it’s not certain, according to the plaintiffs, that 75,995,769 USD allocated for equipment, as envisioned in the contract, was entirely allocated for this purpose.

In search of invoices and payments

The plaintiffs maintain that although payments of 16.2 million USD appear on OTE’s bank statement, there are nevertheless indications that more was paid.

OTE invoiced AOTC for $123 million, as foreseen in the contract. Additionally, the plaintiffs located another three Aegean invoices with the indication “paid”, totaling five million USD, and signed by Dimitris Melissanidis between 31 March 2014 and 2 April 2014, which however, are not included in the 16.2 million USD that the defendants maintain was the total cost. Also, another 30 invoices were identified, signed by Melissanidis, totaling 42,930,795 USD, which were issued between 31 March 2014 and 30 June 2014, and not included in the 16.2 million USD sum.

Moreover, in a “letter dated 20 March 2015, OTE confirmed in response to AOTC’s request for audit confirmation that as of 31 December 2014, the adjusted contract amount was US $123,375,000, total progress billings was US $123,371,677 and the balance due currently was nil.” The lawsuit also states that “Aegean’s internal accounting records identify at least $68 million in payments to OTE.”

The plaintiffs underlined that they are not in position to locate “all the relevant documents, given that certain documents were destroyed by Dimitris Melissanidis.”

Payments even to AEK FC

According to the lawsuit, “…Between January 2015 and January 2018, AMP LLC made 51 further payments to OTE, totalling $186,151,194.05. In the same period, OTE made 19 payments to AMP LLC in the amount of $131,109,971.7192By then the construction of the Fujairah Terminal was complete. There are no contracts, loan agreements or invoices whatsoever between OTE and Aegean that explain these payments. OTE also made payments to AMP SA in the amount of $19,743,581.34.”

Accordingly, these transfers led to a balance of payments of $35,297,641.00 from Aegean to OTE.

In the same period, OTE has paid approximately $36.3 million to a range of people and companies affiliated with or controlled by Dimitris Melissanidis. These include AEK FC, the Association of Friends of AEK and various players and managers.

According to the law suit, “…Emails found on AMPNI’s servers passing between Dimitris Melissanidis, AEK officials and Mr. Vrachypedis reveal that between 2015 and 2018, Aegean funds were channelled through OTE to AEK to pay players and coaches and cover operating deficits. Significantly, these emails once again demonstrate that it was Dimitris Melissanidis who had to authorise payments from OTE to AEK and not Mr. Vrachypedis”.

E-mails about payments to AEK

According to the lawsuit, οn 30 July 2015, AEK’s CEO Alexandros Dedes emailed DM asking “Do we have your approval to send via Oiltank engineering and consulting 60,000 Euros to Seville? … Is it ok to talk with Mr. Vrachypedis?”.

On 25 September 2015, AEK’s Financial Manager, Dimitris Patkas emailed Mr. Vrachypedis copying Dimitris Melissanidis and Mr. Dedes instructing Mr Vrachypedis to “ensure that by the end of the month of 30/9/15 the instalments for VARGAS of €19,890 and for BUONANOTTE €23,880 will be paid”.

On 1 October 2015, Mr. Patkas emailed Mr. Vrachypedis copying Dimitris Melissanidis and Mr. Dedes instructing, Mr Vrachypedis to “make arrangements and proceed with” a payment of €47,200 to another player. OTE made this payment.

On 6 November 2015, Mr Patkas emailed Mr. Vrachypedis copying Dimitris Melissanidis and Mr. Dedes instructing Mr. Vrachypedis that “In the account below you deposit €100,000 for the new coach…”. OTE made that payment. The same email references a separate €1 million loan from OTE to AEK.

On 6 February 2017, Mr. Patkas emailed Dimitris Melissanidis regarding AEK’s budget to the end of the 2017 season. Mr. Patkas identified a budget deficit of €3.5 million for the 2016/2017 season and indicated that there would again be a €5 million deficit for the 2017/2018 season. Mr. Patkas’ proposed solution was a potential loan from OTE “of the range of, let’s say, 5 million to cover the cash deficit.”

On 5 February 2018, Mr Patkas emailed Dimitris Melissanidis outlining a scheme by which AEK would rely upon OTE and Leskira to make player payments: “whoever is paid abroad… should be paid by OIL TANK (Vrachypedis) to the personal accounts of the players they have them abroad (and will be able to justify the money) and PAE will deposit the money to LESKIRA in Greece against a loan payment (171,000 euro).”

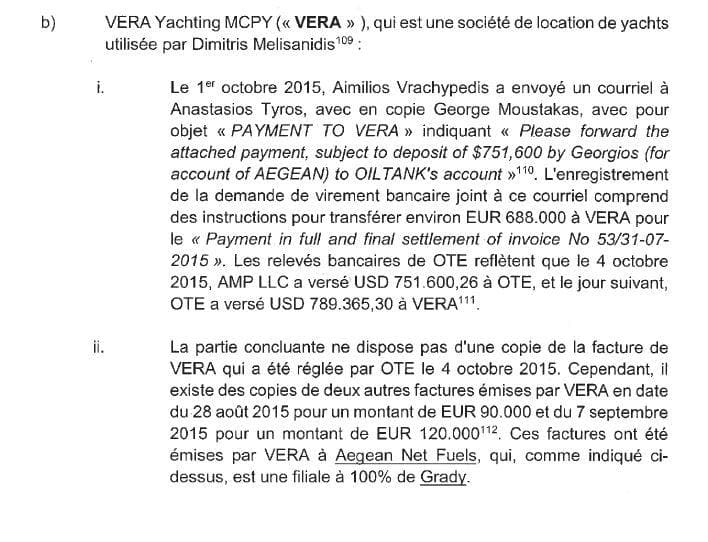

Apart from AEK, money from OTE also went to other payments. The lawsuits points to documents indicating that invoices to yacht rental company that Melissanidis allegedly uses were paid through OTE. Approximately $7.87 million to Ecological Maritime Company, “a Greek company owned by Dimitris Melissanidis”. Payments were made in settlement for invoices for accounting services. Leskira received approximately $2.9 million.

The explanations provided by Melissanidis and the response by the plaintiffs

According to the lawsuit, in the Cyprus proceedings, Melissanidis and OTE insisted that Vrachypedis acquires OTE from Tyros so that he could use it for his future business activities, that OTE made short term loans to Aegean and that The $35 million dollars that OTE received from Aegean and paid out to third parties concerned the settlement of AMPNI’s liabilities to those third parties, i.e. OTE was acting as an intermediary in the settlement of debts owed by AMPNI.

However, the lawsuit insists that there is no evidence that Mr Vrachypedis conducted any businesses using OTE, none of these alleged loans was declared in Aegean’s public filings, that there is no explanation as to how Mr Vrachypedis, an Aegean employee, financed these alleged loans, that “it is not credible that Mr Vrachypedis had the funds to provide a revolving credit facility of this magnitude to Aegean”. According to the lawsuit there is no evidence of third party companies providing loans to Aegean with OTE as an intermediary and “the only money OTE ‘loanded’ to Aegean was money that Aegean had first paid to Aegean”. There is no evidence that these alleged debts from Aegean to the Dimitris Melissanidis affiliated companies ever existed and that there is no evidence to support that claim that Aegean owed these amounts to the third parties. Moreover, according to the lawsuit, one “may wonder how Aegean, a marine fuels business, could have ended up owing $10 million to a football club”.

See here the lawsuit filed in a Luxembourg court

Conclusions-Arendt_01_10_21_TAL1_R_le-TAL-2019-08836-c-3

To be continued…

Latest News

Rhodes Airport Tops Fraport Greece’s Regional Airports in 2024 Performance

According to Fraport's data, more than 35 million passengers (specifically 35.2 million) were handled by Fraport-managed airports during the 11 months.

European Central Bank Cuts Interest Rates by 25 Basis Points

It is the fourth cut of interest rates by Europe’s central bank, a move expected by the markets and financial analysts leading to the rate settling at 3%.

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433