Today, the Greek stock market is going through the… pain of securing profits, which clearly after an impressive session should provide liquidity to participants, satisfying the basic principle of investments.

The general index recorded gains of 0.24%, at 1,204.17 points, with the turnover at 10 million euros.

As expected, the picture of the market today is completely different from yesterday’s impressive rally, but that does not mean that the sentiment has changed. Many portfolios are going through the… fund today in order to lock in some of yesterday’s gains and improve their exposure to a market that sooner or later will be part of an investment grade economy.

As Eurobank Equities analysts point out, “although there will be some mild profit-taking, overall strong momentum will be maintained in the coming weeks as investors assess political risk and the stable economic outlook for Greece, including possible upgrade of Greece to investment grade as early as the second half of 2023. Euroxx estimates the same.

The picture on the dashboard

In terms of securities, EYDAP, Alpha Bank, OPAP, OTE, PPC, Motor Oil, Coca Cola, Eurobank, Terna Energy, Jumbo, GEK Terna and Piraeus are now in positive territory, while Aegean, Ethniki, Hellenic Petroleum, Mytileneos, Titan, Lambda, Biohalco, PPA, Autohellas, Sarantis and ELHA.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

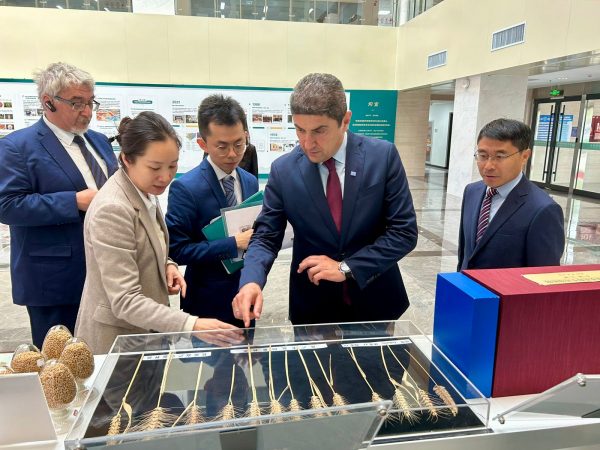

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433