![DBRS: The resilience of the Greek real estate market [charts]](https://www.ot.gr/wp-content/uploads/2021/07/akinita-1.jpg)

The real estate market in Greece showed resilience in 2020, despite the economic shock caused by the pandemic crisis.

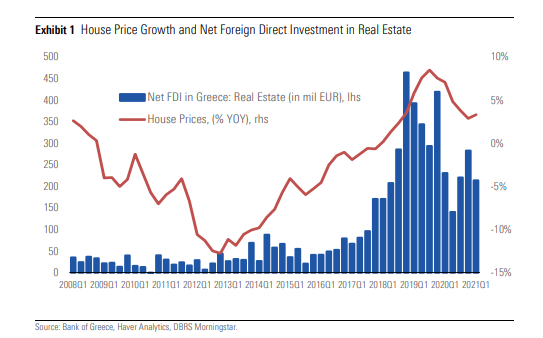

As DBRS comments in its analysis, after the cumulative increase of 9.2% in the period 2018-2019, the increase in house prices slowed down in 2020 due to travel restrictions and other measures for the coronavirus, but price performance remained positive, at 4.6%.

See the study here.

Despite the imposition of restrictive measures in the first quarter of 2021, preliminary data from the Bank of Greece show that house prices continued to rise at a rate of 3.3% per year.

The Greek real estate market is highly dependent on foreign investment, resulting in large price increases in Athens and other popular tourist destinations.

In contrast, prices and transactions in other areas of Greece that are of limited investment interest, although likely to benefit from the effects of “overflow”, are still low.

DBRS estimates in the long run that the development of the real estate market as a whole will depend on Greece’s ability to create jobs and promote policies to support real income growth, while maintaining a stable macroeconomic environment to attract foreign investment.

Specifically, prices in the housing market increased by an average of 4.6% in 2020 and by 3.3% on an annual basis in the first quarter of 2021.

The increase in prices in Athens and Thessaloniki was more intense, reaching 7.6% and 4.8% in 2020 and 5.4% and 3.7% in the first quarter of 2021, respectively, while prices in other cities remained unchanged, according to preliminary data published by the Bank of Greece.

Despite travel restrictions in 2020, increased demand from foreign buyers before the pandemic and the expectation that COVID-19 pandemic restrictions would be temporary prevented a further decline. The construction activity, as measured by the number of building permits, continued with an upward trend, increasing by 8% in 2020 and by 13.7% in the first quarter of 2021.

Prices in areas of the country with low investment interest remain in recession. Clear and strong government support is evidenced by recent legislative interventions, which include reduced taxes on renovation costs, a three-year VAT suspension on new building permits, an adjustment to fair values that could efforts to reduce bureaucracy and improve efficiency in public administration, which could improve planning and speed up sales.

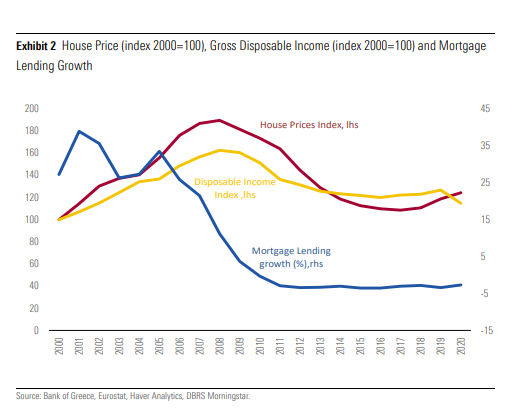

Other policies include the Non-Dom scheme, which was introduced last year and provides tax incentives to those willing to move their tax residence to Greece. In addition, banks’ efforts to clear their balance sheets will boost credit expansion and, therefore, demand. However, mortgages remain low and are likely to remain so.

DBRS estimates that the long-term prospects for the market as a whole will depend on Greece’s ability to recover from the COVID-19 crisis and maintain a stable macroeconomic and political environment

Latest News

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

Lloyd’s List Greek Shipping Awards 2024: Honors for leading companies and personalities in the Greek shipping sector

20 awards presented at the 21st annual Lloyd's List Greek Shipping Awards

Syria’s Bashar al-Assad, His family Granted Asylum by Russia

Reuters also reported that a deal has been struck to ensure the safety of Russian military bases in the war-ravaged country

Greece to Introduce Artificial Intelligence into Its Education System

Currently, Greece is taking its first steps to bring AI into classrooms through the AI4edu program, which is being co-funded by the European Union

Greek PM Mitsotakis Announces Interventions in Banking Sector

Addressing banking fees, the prime minister emphasized the need for a more competitive banking system that benefits borrowers and depositors alike

FT: Exarchia’s Farmers’ Market in Athens Ranked Among the World’s Best

Musicians play traditional Greek tunes as vendors call out to showcase their goods, which include olive oil, honey, fresh fish, herbs, and a variety of vegetables.

‘Greece 1974-2024: 50 Years of Greek Foreign Policy’ Conference Set for Dec. 12-13

The conference, held at the King George Hotel in Athens, will also be live-streamed

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433