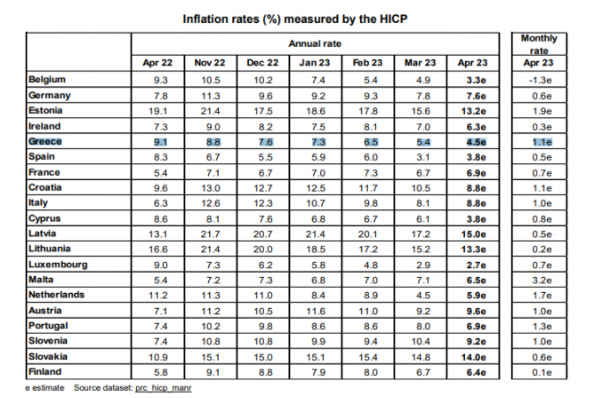

Eurozone inflation reached 7% in April 2023, from 6.9% in March, according to Eurostat’s emergency estimate. Inflation in Greece shrank to 4.5% in the month of April, according to Eurostat’s provisional data. This is the fifth lowest inflation among the Eurozone member states.

It is recalled that inflation in Greece reached 5.4% in March 2023 (from 6.5% in February), while 6.9% is the corresponding rate at the Eurozone level, according to Eurostat’s final data for the previous month.

Looking at the main components of euro area inflation, food, alcohol and tobacco are expected to have the highest annual rate in April (13.6%, up from 15.5% in March), followed by non-energy industrial goods (6 .2%, compared to 6.6% in March), services (5.2%, compared to 5.1% in March) and energy (2.5%, compared to 0.9% in March).

Small drop in structural inflation

Excluding volatile food and fuel prices, core inflation slowed to 7.3% from 7.5%, while an even narrower measure, which excludes alcohol and tobacco, slowed to 5.6% from 5. 7%, short of forecasts for 5.7% and is the first decrease since last June.

In a hopeful development for the ECB, inflation for processed food, alcohol and tobacco slowed by a full percentage point to 14.7%, suggesting that the long-awaited turnaround in food prices may now be taking place.

The small surprise on core inflation comes as the ECB’s quarterly survey of bank lending points to an unusually large fall in credit demand amid tighter lending criteria, bolstering the case for a smaller rate hike.

The ECB has raised interest rates by at least 50 basis points at each of its last six meetings.

The image in Germany, France and Spain

German inflation unexpectedly eased in April after economic difficulties in early 2023. Consumer prices rose 7.6% year-on-year, down from 7.8% in March, a rate economists had expected to hold.

The country’s statistical office attributed the slowdown to goods and services.

Inflation in the eurozone’s second-largest economy unexpectedly accelerated to 6.9% in April, driven by energy and services costs.

It had risen 6.7% in March, more than the average estimate in a Bloomberg survey of economists, which expected France to remain flat

In Spain, inflation rose to 3.8% year-on-year in April, from 3.3% in March.

Fed and ECB moves

The FED is expected to raise interest rates again by 25 basis points on May 3rd, while a day later, on May 4th, the ECB is expected to make its own increase ranging from 25 to 50 basis points. For the FED, market factors estimate that it may then hit the brakes for this year, while the ECB may continue the hikes at least for June and July as well. But everything is still fluid as both central banks have put inflation under the microscope, since this will be the key factor that will determine their decisions.

What central bankers are saying

Some policymakers, including French central bank chief Francois Villeroy de Galhau, have argued for a more measured move this month, arguing that the ECB has already raised borrowing costs sharply enough to constrain the economy.

But others, including board member Isabel Schnabel, said a 50-basis-point move should remain among the options because rate hikes are proving sticky, raising the risk of flatlining above the ECB’s 2 percent target.

Almost all 26 members of the Governing Council appear to agree that more policy tightening is needed after a record 350 basis points in rate hikes since July.

Stability Program and scenarios for Greece

It is worth noting that inflation to 4.5% for this year and de-escalation to 2.4% in 2024 and 2% in the years 2025 and 2026, includes among others the Greek Stability Program for the years 2023-2026 submitted by the Greek government in Saturday, April 29 at the Commission.

The program is also accompanied by a sensitivity analysis concerning a monetary shock scenario, in accordance with the Commission’s instructions for the country’s programs. In this context, it examines the effects on economic activity and public finances of adverse developments in inflation and interest rates.

Specifically, the analysis examines a type of the following alternative scenarios:

A rise in oil, gas and commodity prices through 2023, leading to 0.5% higher overall inflation for the current year (Scenario A).

A monetary shock that raises interest rates by 50 basis points in 2023 relative to the baseline scenario (Scenario B).

Latest News

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

Lloyd’s List Greek Shipping Awards 2024: Honors for leading companies and personalities in the Greek shipping sector

20 awards presented at the 21st annual Lloyd's List Greek Shipping Awards

Syria’s Bashar al-Assad, His family Granted Asylum by Russia

Reuters also reported that a deal has been struck to ensure the safety of Russian military bases in the war-ravaged country

Greece to Introduce Artificial Intelligence into Its Education System

Currently, Greece is taking its first steps to bring AI into classrooms through the AI4edu program, which is being co-funded by the European Union

![Χειμερινή εξοχική κατοικία: Οι Ελληνες γυρνούν την πλάτη παρά την πτώση των τιμών [γραφήματα]](https://www.ot.gr/wp-content/uploads/2024/12/Capture-19-90x90.jpg)

![Χειμερινή εξοχική κατοικία: Οι Ελληνες γυρνούν την πλάτη παρά την πτώση των τιμών [γραφήματα]](https://www.ot.gr/wp-content/uploads/2024/12/Capture-19-600x294.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433