Thanks to high prices and summery weather, electricity demand in October continues its downward trend for the third month in a row. In particular, the average system load reached 4,977 MW, down 10% compared to September and 6% year-on-year. Thus, the use of natural gas in power generation also appears reduced, covering 26% of the fuel mix, compared to September when it had reached 37%.

In September electricity demand had also decreased by 13% compared to August (and by 3% on an annual basis), while the decrease in August compared to July was similar.

Regarding Greece’s fuel mix in electricity generation during the month of October – according to recently processed data from the Department of Analysis and Studies of the Energy Institute of Southeast Europe (IENE) – 46% was based on Renewable Energy Sources (from 34% in September), in natural gas (26% from 37% last month), net imports (16% from 13% in September), lignite (8% from 11%) and large hydro (4%).

Green energy at 50%

So, the participation of “green” energy (RES and hydro) reached 50% from 39% in September. In total, energy production from RES and natural gas last month amounted to 1,603,986 MWh and 913,949 MWh respectively, while from lignite it reached just 292,269 MWh.

On an annual basis, the share of natural gas in Greece’s fuel mix decreased by 24% (from 50% in October 2021 to 26% in October 2022) while the contribution of RES increased by 10% (from 36% to 46% ).

Drop in electricity prices

The average Market Clearing Price (MTP) on the Hellenic Energy Exchange, in October, was reduced by 44% compared to September and amounted to 232.77 euros/MWh, while it increased by 17% compared to October 2021 .

It is also fluctuating at low levels in November, with the average of the month being at 196.87 euros/MWh, which foreshadows significantly lower charges from electricity providers, thus zero participation of the budget in rate subsidies from the state.

Increased power inputs

Imports increased in October (compared to September 2022), given that Greece was the most expensive wholesale electricity price among neighboring markets. Monthly electricity imports rose to 870,388 MWh in October from 797,745 MWh in September.

Distribution of Greek electricity imports by interconnection: 29% came from Bulgaria, 23% from North Macedonia, 22% from Albania, 22% from Italy and 4% from Turkey. Exports also increased, reaching 330,203 MWh (from 308,046 MWh in September). Thus, Greece’s total net imports for October amounted to 540,185 MWh from 489,699 MWh in the previous month.

Increase in gas export demand

At the same time, for the first nine months of 2022, the upward trend in the overall demand for natural gas continues, driven by natural gas exports, mainly to Bulgaria, according to National Natural Gas Transmission System data. The main entry gates, for the specific period, were the LNG terminal of Revythoussa (entry point Agia Triada) and the TAP pipeline (entry point Nea Mesimvria).

In particular, according to Institute of Energy for South East Europe (IENE), in the period January – September, the total demand for natural gas (domestic consumption and exports) increased by 13.47% (to 65.39 TWh), compared to the same period last year. However, it is noteworthy that there was a decrease of 14.25% in domestic consumption (from 52.46 TWh to 44.98 TWh), while the increase in natural gas exports by 294.73% (from 5.17 TWh to 20 .41 TWh).

The largest quantities entered the country from the Revythoussa LNG terminal, which covered 42.62% of imports, recording an increase that is a historical record. In particular, approximately 27.85 TWh of LNG were unloaded from 60 tankers coming from 6 countries, compared to approximately 18.14 TWh from 25 tankers in the corresponding period of the previous year.

The increase mainly concerns LNG cargoes from the USA, which reached 18.67 TWh, compared to 8.04 TWh in the same period last year, with the USA remaining the largest importer of LNG in Greece, with a percentage of 67.05%. In second place are imports from Algeria (3.95 TWh), followed by Nigeria (2.07 TWh), Egypt (2 TWh), Oman (1.03 TWh) and Indonesia (0.11 TWh) .

As for the gas that enters our country through pipelines, through Sidirokastro it reached 35.7% (23.34 TWh), through Nea Mesimvria (it is connected to the TAP pipeline), 19.16% (12.53 TWh) and through Kipi Evros 2.5% (1.64 TWh).

71.96% drop in industry gas demand

Power producers remain the biggest consumers of natural gas covering 73.7% of domestic consumption with 33.15 TWh out of a total of 44.98 TWh consumed, an amount 6.24% lower than in the same period last year.

Consumption recorded in households and businesses through the distribution networks (9.58 TWh) increased by 5.46% compared to the corresponding nine months of 2021, which corresponds to 21.3% of demand. Gas (and CNG) consumption by domestic industries reached 2.24 TWh between January and September 2022, recording a decrease of 71.96% compared to the corresponding period of 2021 and covering approximately 5% of demand.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

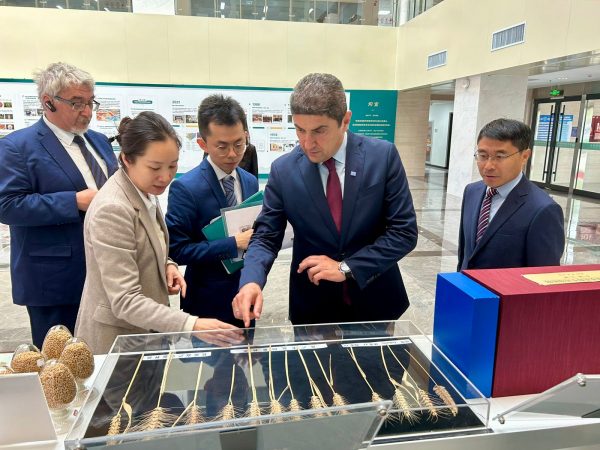

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

![Απάτες: Eκρηξη στις ηλεκτρονικές επιθέσεις σε τραπεζικές κάρτες πληρωμών [γραφήματα]](https://www.ot.gr/wp-content/uploads/2024/04/phishing-apati-pistotiki-karta-laptop-600x300.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433