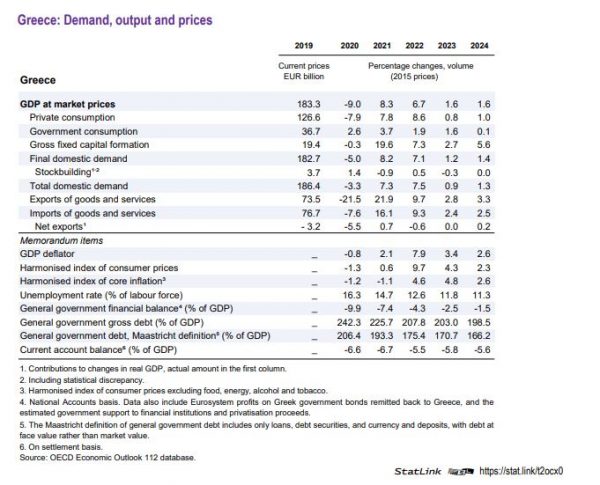

The OECD “sees” a reduction in inflation and a slowdown in the rate of growth of the Greek economy. Also, in a report, which was made public a while ago, he estimates that there will be a return to primary surpluses and an expansion of the current account deficit.

In its report, the OECD predicts that annual harmonized inflation will shrink sharply this year to 3.7% from 9.5% in 2022 and return to normal levels at 2.3% next year.

In terms of Greek GDP, the Greek economy is estimated to expand by 1.1% this year and 1.8% in 2024 from 5.1% in 2022, with exports falling by 0.5% this year and the current account deficit to widen to 8.9% this year from 7.1% last year.

Debt and surplus

At the same time, the public debt from 175.1% of GDP in 2022 will fall to 170.7% this year and to 163.6% in 2024 with the OECD noting that despite its reduction it remains high although its structure in combined with fixed interest rates locked at low levels to service it limit immediate exposure to market rate increases.

Regarding the primary result, the OECD adopts the government’s estimate of a primary deficit of 1.6% of GDP in 2022, marginally lowering the threshold for forecasts for this year’s primary surplus of 0.5% of GDP. For 2024, it forecasts a primary surplus of 1.5% of GDP, accompanied by recommendations to maintain an annual primary surplus between 1.5% and 2% for the years after 2023.

Investment grade

“The restoration of primary budget surpluses is necessary, given rising inflation, notes the OECD. Effective use of Recovery Fund resources, pursuing a broader and more equitable revenue mix and improving public sector efficiency will enable public finances to support investment, incomes and inclusion,” the OECD says.

It also emphasizes that the limitation of the country’s financial needs and the steady reduction of the public debt are of decisive importance for Greece to see its credit rating upgraded to the investment grade. This in turn would facilitate financing and investment.

Banks

Banks have to show significant progress in reducing bad loans, according to the OECD. However, these banks’ funds remain low and mainly consist of deferred tax assets. This “acts as a drag on new lending and weakens banks’ ability to invest.” The OECD recommends that the government encourage banks to further strengthen their capital base by increasing organic profitability.

From then on, according to the Agency, the support measures, the boosting injections from tourism and exports brought the GDP back to pre-coronavirus levels. At the same time, the improvement of the consumer and investment climate, such as the ongoing reforms, worked in favor of the business environment and contributed to the attraction of foreign direct investments. These factors contributed to strong job growth and a drop in the unemployment rate to a 12-year low.

The consequences of war

However, soaring energy prices, problems in the supply chain and geopolitical uncertainties, especially after Russia’s invasion of Ukraine, are coming to create problems for the recovery. “The war directly affects the energy supply and energy costs of Greece. The indirect effects are a squeeze on spending and a delay in investment and hiring,” notes the OECD. “The release of resources from the Recovery and Resilience Fund and the extension of fiscal support to energy consumers act as a buffer to these shocks and will help to get the economy back on track when energy prices stabilize,” he notes.

Minimum wage and sectoral contracts

On wages, the OECD reports that the government has increased the minimum wage by almost 10% in the first half of 2022, while adding that in some specialties, such as ICT and construction workers, wage increases are larger. While the OECD acknowledges that raising the minimum wage “provides a safety net for workers who lack bargaining power,” it also notes that it has also become the “primary source of wage adjustments for many workers who earn more than the minimum wage.”

However, according to the Organization, the reinforcement of the incomes of the workers in Greece cannot come exclusively from the bottom. The report emphasizes sectoral bargaining, stating that “Sectoral collective bargaining on wages and working conditions would better support both incomes and productivity.”

Youth and women unemployment is a “problem”.

The employment rate remains low, especially for women and young people, the report says, with the Agency recommending promoting women’s participation in paid employment including encouraging employers to adopt more flexible working arrangements, but also strengthening incentives for employers in order to hire new workers with limited experience.

Latest News

DM Dendias: We talk With Turkey But We Always Bring Up Their Unacceptable Positions

Second and last day of closely watched conference, entitled 'Metapolitefsi 1974-2024: 50 Years of Greek Foreign Policy', also included appearances by PM Mitsotakis, Ex-PM Tsipras and PASOK leader Nikos Androulakis, among others

Rhodes Airport Tops Fraport Greece’s Regional Airports in 2024 Performance

According to Fraport's data, more than 35 million passengers (specifically 35.2 million) were handled by Fraport-managed airports during the 11 months.

European Central Bank Cuts Interest Rates by 25 Basis Points

It is the fourth cut of interest rates by Europe’s central bank, a move expected by the markets and financial analysts leading to the rate settling at 3%.

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

![Φυσικό αέριο: Δυναμικό come back του LNG στην Ελλάδα [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/01/OT_naturalgas-90x90.jpeg)

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

![Φυσικό αέριο: Δυναμικό come back του LNG στην Ελλάδα [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/01/OT_naturalgas-600x474.jpeg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433