Today, the Greek State will go to the markets, a few days before the national elections, in order to raise 400 million euros by reissuing 10-year and 15-year bonds.

An auction will be held for the reissuance, as announced by the Public Debt Management Agency (P.D.M.A.), of the following Greek Government Bonds:

a) fixed interest rate of 4.25%, due June 15, 2033, in intangible form, ISIN GR0124039737,

b) fixed interest rate of 4.00%, maturity 30 January 2037, in intangible form, ISIN GR0133011248.

The purpose of the reissuance is to satisfy investment demand and at the same time to facilitate the functioning of the secondary bond market.

The amount

The amount to be auctioned will be:

a) up to 250 million euros for bonds maturing on June 15, 2033,

b) up to 150 million euros for bonds maturing on January 30, 2037.

The settlement date will be Wednesday, May 24, 2023 (T+5).

Only Primary Dealers will participate in the auction by submitting, through the Electronic Secondary Securities Market (HDAT), exclusively up to 5 competitive bids each, which must be submitted by 12:00 noon (pm), local time, on the 17th May 2023 and which are satisfied up to the amount of the auctioned amount, at the price of the last bid accepted at the auction (cut off price).

Only competitive bids will be accepted at the auction. This auction will be taken into account for the evaluation of the B.D., while no commission will be given for the Bonds.

Latest News

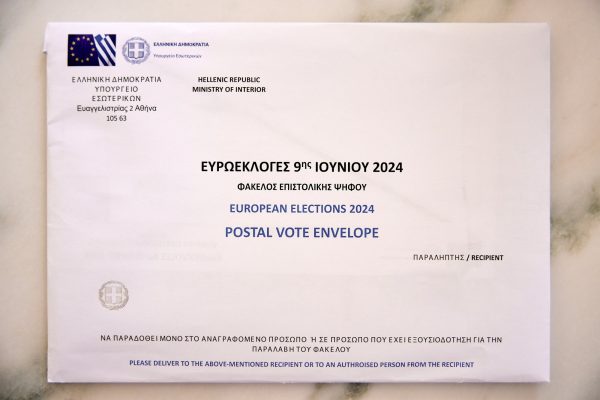

Deadline for Postal Vote Registration Expires on Mon.

More than 157,000 Greek citizens had registered on the relevant online platform so far

Orthodox Palm Sunday Today; Shops Open in Greater Athens-Piraeus Area

Orthodox Holy Week begins on Monday, April 29, and ends on Sunday, Easter Sunday or Great and Holy Pascha (May 5)

Greek Retailers Remain Optimistic About Easter Shoppers’ Turnout

While stores are expected to be open on Sunday, April 28, the majority of Easter shoppers will likely do their shopping during the Holy Week, following the deposit of Easter bonuses

Europeche: Greek Apricot Production Recovers

Europeche forecasts the production will bounce back despite a slight decrease in varieties attributed to high winter temperatures

Bank of Greece (BoG): Business-Household Deposits Up 1,675bln in March 2024

In March 2024, the monthly net flow of credit to the general government was negative by 469 million euros

FT: Greece’s Economic Rebound a Balance of Growth and Poverty

Eurostat data revealed a significant 10.8% drop in Greek public debt relative to GDP in 2023, alongside a 2% economic expansion, outpacing Germany's performance.

Lavrio Port Authority Next Up for Privatization

A deadline for the submission of expressions of interest is May 14, 2024

Eurostat: Greece Records Largest Drop in Natural Gas Prices in 2nd Half of 2023

The price of electricity and natural gas in Europe was down following a substantial surge that began before the Russian invasion of Ukraine and peaked in 2022

GEK TERNA Still Considers Leveraging Concessions Portfolio as Financial Tool

President and CEO of Gek Terna George Peristeris explained the company's plans on Tuesday on the sidelines of the inauguration of sections of Greece's E65 highway

NielsenIQ: 3% Supermarket Revenue Increase in Q1

Private label products are gaining traction, comprising 25.4% of shopping basket shares, up from 24.7%

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433