The cost of hotter summers, as well as fires, on southern Europe’s critical tourism sector was looked into by Moody’s rating agency, estimating that it is possible to see more tourists choosing to take holidays in early autumn and late spring to avoid the warmer months.

Moody’s does not expect a massive decline in tourism in Southern Europe in the short term. It remains a popular summer destination with consistently warmer and drier weather than Northern Europe.

2023 in running to beat out 2019 as best tourism season ever in Greece

But, in fire-prone areas, there is potential for property values to decline. Lower valuations can make it harder for companies with a lot of real estate to secure financing because the security that real estate ownership typically provides to creditors is reduced when valuations fall. However, southern Europe was already exposed to fire risks and this is already reflected in valuations, which remained broadly stable in 2022 thanks to a strong recovery in tourism.

Climate impacts

Moody’s recalls that on October 2, the Spanish meteorological agency Agencia Estatal de Meteorología (AEMET) said that the first day of October was the warmest since records began, with temperatures between 7 – 14 degrees above normal for the time of year. And as Moody’s explains, more frequent heatwaves and fires are negative for tourism companies that are more exposed to Southern Europe.

Of course, most of the companies it assesses are large and geographically diversified and have had strong post-pandemic recoveries, making it unlikely that their credit quality will be affected as much as smaller ones.

Le Figaro: The Greek island-model against hypertourism

Loans to small operators operating locally are part of the Spanish and Italian Small and Medium Enterprises (ABS SME) collateral-backed transactions. However, the negative credit impact of more frequent fires and heat on these local operators is offset by the industry and geographic diversification of most portfolios.

Increase in operating costs

Moody’s expects costs to increase as a result of increased extreme weather events. Companies may face additional costs if clients require repatriation (with interruption of stay) or alternative accommodation. Energy costs, which account for 10%-20% of housing companies’ operating costs, excluding staff costs, are likely to increase as buildings need air conditioning for longer periods in hotter summers.

Energy costs will rise the most in popular summer holiday destinations such as Italy and Croatia which are exposed to the risks of warming and also rely heavily on hydropower for their energy needs. This is because their ability to produce energy is reduced in conditions of extreme heat and drought.

Cost increases will be easier for larger, more diversified companies to absorb because they will be less significant relative to their size. After the fires in Rhodes this summer, the German tourism company TUI spent 25 million euros on cancellations, compensation and repatriation flights. However, this was less than 2% of its total EBITDA for the 12 months to June 2023. Despite being smaller than most other European accommodation companies, German hotels and hostels company Alpha Group SARL (A&O Hotels and Hostels ) is geographically well diversified, operating 38 hostels in nine countries as of March 2023. It is also concentrated in Germany and Austria, where it generated 72% of its revenue in 2022, even as it has increasing exposure in Southern Europe, with plans to to open facilities in Barcelona and Florence this year.

Mathilde from France shelters from the sun with an umbrella near the Colosseum during a heatwave across Italy, in Rome, Italy July 11, 2023. REUTERS/Guglielmo Mangiapne

Fires

Heatwaves and wildfires create temporary difficulties with bookings and travel due to customer safety concerns. More frequent fires and heat waves may lead to higher cancellation rates and lower last-minute bookings. NH Hotel Group SA’s four properties in Sicily were not directly affected by the fires this summer. However, in the three-week period of the fires, cancelations increased by up to 5% of overnight stays. NH is broadly diversified, so the impact of this temporary and limited increase in cancellations was minimal.

Greek luxury travel company Sani/Ikos Group SCA said cancellations were not up much at its two Corfu resorts where there were problems in July. Last minute bookings were lower than in previous years. However, its hotels are booked months in advance, so last-minute bookings contribute only a small portion of total revenue. Sani/Ikos is highly concentrated in the Greek coastal areas where it generated 84% of total revenue in 2022. It is also increasing its geographic diversification with the opening of a resort in Porto Petro, Spain this year and additional projects in Spain and Portugal’s Algarve in next two years. Sani/Ikos bookings for 2024 so far are similar to previous years.

However, southern Europe risks becoming less attractive as a holiday destination if heatwaves and fires become more frequent. If this happens, accommodation operators may struggle to maintain their current strong pricing power. Room rates peaked this summer with an average daily rate (ADR) of €202 in Southern Europe and €164 for Europe as a whole, respectively 39.6% and 39.1% higher than summer 2019, before the pandemic. However, between July 2022 and July 2023, ADRs increased less in Southern Europe than across Europe overall, by 7.4% and 7.5% respectively.

Tourism accounted for 11.5% of gross value added in the Greek economy in 2019, 11.3% for Croatia, 6.9% for Spain and 6.2% for Italy, according to Eurostat. However, Moody’s would expect local and central governments to increase precautionary measures to offset some of the risks of hotter summers. More visitors may also choose to vacation in early fall and late spring to avoid the warmer months, extending the season and reducing visitor numbers.

Demand for Northern Europe is still small

Companies with exposure to both southern and northern Europe such as TUI and Casper MidCo SAS could benefit from a shift in demand to more northerly destinations, according to a study by the Intergovernmental Panel on Climate Change. However, Moody’s does not expect a massive decline in tourism in Southern Europe in the short term.

It remains a popular summer destination with consistently warmer and drier weather than Northern Europe. And finally, in fire-prone areas, there is the potential for property values to decline. Lower valuations can make it harder for companies with a lot of real estate to secure financing because the security that real estate ownership typically provides to creditors is reduced when valuations fall. However, southern Europe was already exposed to fire risks and this is already reflected in valuations, which remained broadly stable in 2022 thanks to a strong recovery in tourism.

Latest News

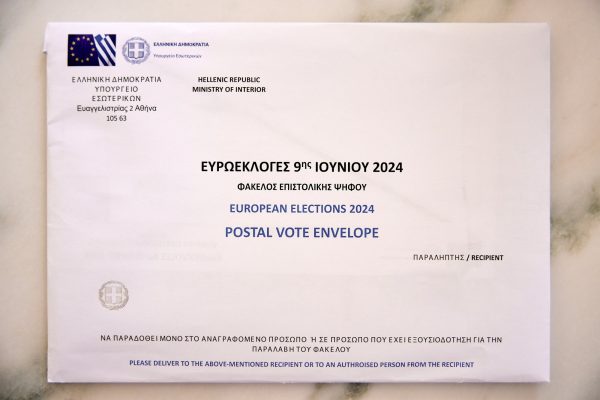

Deadline for Postal Vote Registration Expires on Mon.

More than 157,000 Greek citizens had registered on the relevant online platform so far

Orthodox Palm Sunday Today; Shops Open in Greater Athens-Piraeus Area

Orthodox Holy Week begins on Monday, April 29, and ends on Sunday, Easter Sunday or Great and Holy Pascha (May 5)

Greek Retailers Remain Optimistic About Easter Shoppers’ Turnout

While stores are expected to be open on Sunday, April 28, the majority of Easter shoppers will likely do their shopping during the Holy Week, following the deposit of Easter bonuses

Europeche: Greek Apricot Production Recovers

Europeche forecasts the production will bounce back despite a slight decrease in varieties attributed to high winter temperatures

Bank of Greece (BoG): Business-Household Deposits Up 1,675bln in March 2024

In March 2024, the monthly net flow of credit to the general government was negative by 469 million euros

FT: Greece’s Economic Rebound a Balance of Growth and Poverty

Eurostat data revealed a significant 10.8% drop in Greek public debt relative to GDP in 2023, alongside a 2% economic expansion, outpacing Germany's performance.

Lavrio Port Authority Next Up for Privatization

A deadline for the submission of expressions of interest is May 14, 2024

Eurostat: Greece Records Largest Drop in Natural Gas Prices in 2nd Half of 2023

The price of electricity and natural gas in Europe was down following a substantial surge that began before the Russian invasion of Ukraine and peaked in 2022

GEK TERNA Still Considers Leveraging Concessions Portfolio as Financial Tool

President and CEO of Gek Terna George Peristeris explained the company's plans on Tuesday on the sidelines of the inauguration of sections of Greece's E65 highway

NielsenIQ: 3% Supermarket Revenue Increase in Q1

Private label products are gaining traction, comprising 25.4% of shopping basket shares, up from 24.7%

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433