The country, today, August 20, exits from the enhanced surveillance regime and is “almost” free to design its own financial policy according to European fiscal rules. In short, the enhanced surveillance regime that the Greek economy “inherited” after the three consecutive bailout programs from 2010 to 2018 is officially abolished.

The Greek economy will now be assessed every six months by the institutions, rather than every quarter, while the Greek government is called upon to continue its prudent fiscal policy without jeopardising both debt reduction and the achievement of the target of returning to a primary surplus of 1.1% of GDP, in 2023.

The country of course remains under surveillance, as is the case with many other countries in the bailout programmes, such as Ireland, Spain, Cyprus and Portugal. Surveillance will continue until Greece repays 75% of the loans, which will happen in 2059, according to the current plan.

The first audit

The first audit under the post-program surveillance should be completed in November, ahead of the budget submission, while the decision on the disbursement of the last tranche of ANFAs and SMPs, amounting to more than €700 million, will also be launched. The liquidity injection is scheduled for December after the Eurogroup decision, while the last outstanding issue in order for Greece to “turn over a new leaf” is the recovery of the investment grade in 2023.

What exit offers

What the exit from enhanced surveillance “offers”, among other things, a positive assessment of the Greek economic policy, despite successive crises, and sends a message to markets and investors. If the Greek economy manages to regain investment grade status in 2023 – which requires very careful steps in terms of fiscal policy due to the high level of debt – then Greece will have “cast of the stigma” of the 2009 crisis. Back then, with continuous downgrades, it had lost its investment grade and the Greek credit rating entered the “junk” status, resulting in borrowing at prohibitively high interest rates, being excluded from the markets and needing help from the IMF and the EU.

The 2008 global financial crisis and the Greek debt crisis

Interestingly, the Financial Times recently took a look back at how it describes Greece’s entry into deep austerity and the Greeks in a long period of economic shocks. Going back in time, the Financial Times recalls that the 2008 global crash plunged Greece into a debt crisis that led to successive EU and IMF bailouts starting in 2010. In the decade that followed, they report, the country’s economy shrank by a quarter and the disposable income of Greeks fell by a third, due to the austerity policies imposed by the ‘troika’ of the Commission, IMF and ECB. Thousands of young Greeks left the country in search of work, with unemployment soaring to 27.8% in 2013, while governments made drastic cuts in pensions and public institutions in order to receive financial aid. The strict conditions of the programmes, dictated mainly by Germany, almost pushed Greece out of the euro in 2015. The third ‘economic adjustment programme’ expired in June 2018, but Brussels has kept Greece’s finances under surveillance ever since.

2010 and the Memoranda

2010 is a historic year for Greece, but also for the entire Eurozone. Greece’s exclusion from the markets led the European partners to make crucial decisions such as the “entry” of the International Monetary Fund into Europe. In order to avoid bankruptcy, Greece resorted to the support mechanism under the supervision of the “troika” (IMF, EU, ECB). The lenders demanded fiscal adjustment as a ‘quid pro quo’. The European Stability Mechanism had not yet been established and therefore the expertise of the IMF was deemed necessary. Later, and after three Memoranda of Understanding, the lenders in their reports recorded the admission of mistakes in the management of the Greek crisis as society was shocked by the violent fiscal adjustment and severe austerity.

The three programs

Financing under the first program was provided through bilateral loans from euro Member States to Greece through the Financial Facility (Eurogroup, 2 May 2010). Under the first programme, Greece received a total amount of EUR 52.9 billion in financial assistance and then the IMF paid an additional amount of around 20 billion euros.

The second adjustment program replaced the first one. We recall that it was adopted on 9 March 2012 and lasted until June 2015. The financing was provided by the euro area countries through the European Financial Stability Facility (EFSF). The EFSF paid 141.8 billion euros and the IMF about 12 billion euros.

Finally, the third economic adjustment program started on 19 August 2015 and lasted until 20 August 2018. It was provided by the European Stability Mechanism and disbursed 46.9 billion euros. At that time, the IMF was not involved but was given an advisory role. The last programme ended on 20 August 2018 and, since then, Greece has not been dependent on bailout loans. However, Greece was under enhanced surveillance, with quarterly assessments, until August 2022.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

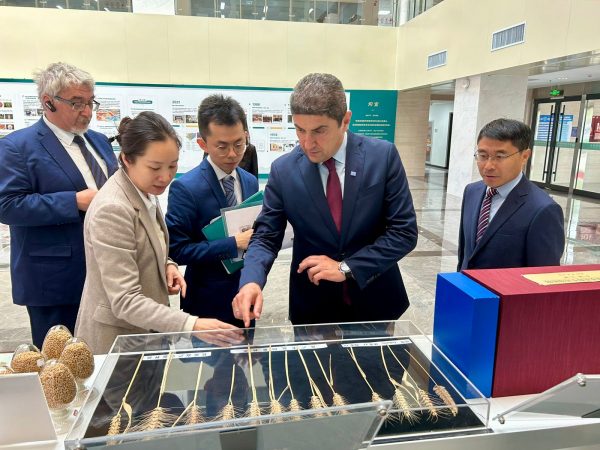

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433