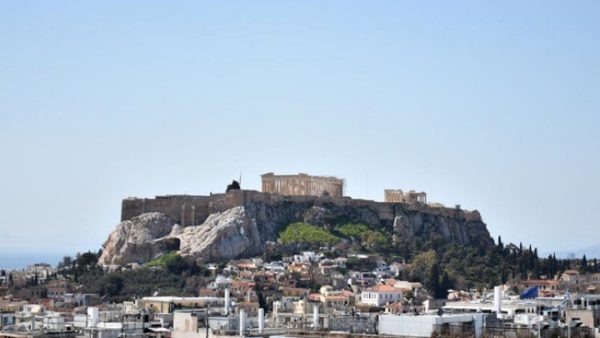

In a new article, the editorial team of the Financial Times refers to the upcoming elections in Greece on Sunday, May 21, and mainly to the return of the Greek economy to investment grade. After all, the title of this very article wants to indicate that Greece’s recovery from the debt crisis is indeed impressive, but the next government must remain committed to this goal and not deviate from the path towards returning to investment grade.

From 2015 to today

The authors of the article attempt to review the recovery of the Greek economy from 2015 to today, a year , in which according to the FT, Greece was on the brink of economic collapse. Despite having weathered the storm of the financial crisis and the debt crisis, aftershocks are still “shaking” the Greek economy. Greece’s debt ballooned and its economy was downgraded to “junk” level.

The so-called troika of institutions (the International Monetary Fund, the European Commission and the European Central Bank) were desperately trying to save the Greek economy, amidst intense concern that it is only a matter of time before Greece left the Eurozone.

The conditions set by the institutions brought the rescue packages and with them harsh austerity measures. Increases in taxes, cuts in State salaries, changes in the pension system (cuts and recalculation of their amount).

In this particularly stressful environment for Greek taxpayers, in 2018 Greece manages to exit the third and final memorandum and in the summer of 2022 it also exits the regime of enhanced supervision.

Return to the present day

Currently, Greece’s economy is one of the fastest growing economies in the Eurozone and the feeling that it will regain investment grade by the end of the year is strong. The country’s central banker also considers this scenario very likely.

Since 2019, Prime Minister Kyriakos Mitsotakis – leader of the ruling New Democracy party – has adopted a policy that is business and investment friendly and has also implemented a relatively orthodox management of the economy. Foreign direct investment and exports have increased significantly, with the result that the Greek economy is 6.4% higher than pre-pandemic levels.

Although during the pandemic Greece’s debt-to-GDP ratio soared above 200%, last year the ratio fell by more than 20 percentage points and the government ran a small primary budget surplus. Enhanced fiscal prudence means that Greek bond spreads against German bonds have narrowed broadly since the height of the eurozone debt crisis, and Greek debt now trades at almost the same level as Italy’s.

Nevertheless…

The reversal of this image clearly needs to be highlighted according to the FT. But as the editorial team points out, in the final stretch for the parliamentary elections next Sunday, it is vital that any government that emerges continues the progress that has been achieved in previous years.

Although the recovery is impressive, reforms are still needed. Greece still has the highest debt ratio in the eurozone and its economy remains about a fifth smaller than it was in 2008.

The shrinking debt is also due to high inflation. Today’s crisis in the cost of living is once again weighing on household finances after years of austerity: Greece has one of the highest rates in the European Union of population at risk of poverty and social exclusion.

The recent wiretapping scandal, on the one hand, damaged the image of the Greek prime minister, and on the other hand highlighted Greece’s problems with the rule of law.

The fatal accident in Tempe brought to light in the most tragic way the inadequacy of public services and infrastructure.

The government is also accused of illegally pushing back refugees at its borders and controlling the media.

The day after elections

After Sunday’s election, political uncertainty will soar. The conservative New Democracy party is not expected to secure the majority required to form a government.

Greece will probably go to the polls again in the summer and New Democracy may need to proceed with cooperation for a coalition government with third in polls PASOK. SYRIZA, the radical left opposition party, is pushing for a more expansionary fiscal policy to tackle social issues – how far it will go is unclear, according to the FT.

Whoever comes to power will have to capitalize on the gains of the last decade. The relatively long duration of its debt and the 30.5 billion euros it is due to receive from the Recovery Fund until 2026 give Greece a unique opportunity to strengthen its economy and further reduce its debt.

“Diversifying the economy away from its dependence on tourism, promoting long-term investment growth and wider reforms of public services and justice should be priorities.

Greece has suffered in the last decade. But her sacrifices mean she now has the chance to turn adversity into prosperity. She must not lose this chance,” the article concludes.

Latest News

Deadline for Postal Vote Registration Expires on Mon.

More than 157,000 Greek citizens had registered on the relevant online platform so far

Orthodox Palm Sunday Today; Shops Open in Greater Athens-Piraeus Area

Orthodox Holy Week begins on Monday, April 29, and ends on Sunday, Easter Sunday or Great and Holy Pascha (May 5)

Greek Retailers Remain Optimistic About Easter Shoppers’ Turnout

While stores are expected to be open on Sunday, April 28, the majority of Easter shoppers will likely do their shopping during the Holy Week, following the deposit of Easter bonuses

Europeche: Greek Apricot Production Recovers

Europeche forecasts the production will bounce back despite a slight decrease in varieties attributed to high winter temperatures

Bank of Greece (BoG): Business-Household Deposits Up 1,675bln in March 2024

In March 2024, the monthly net flow of credit to the general government was negative by 469 million euros

FT: Greece’s Economic Rebound a Balance of Growth and Poverty

Eurostat data revealed a significant 10.8% drop in Greek public debt relative to GDP in 2023, alongside a 2% economic expansion, outpacing Germany's performance.

Lavrio Port Authority Next Up for Privatization

A deadline for the submission of expressions of interest is May 14, 2024

Eurostat: Greece Records Largest Drop in Natural Gas Prices in 2nd Half of 2023

The price of electricity and natural gas in Europe was down following a substantial surge that began before the Russian invasion of Ukraine and peaked in 2022

GEK TERNA Still Considers Leveraging Concessions Portfolio as Financial Tool

President and CEO of Gek Terna George Peristeris explained the company's plans on Tuesday on the sidelines of the inauguration of sections of Greece's E65 highway

NielsenIQ: 3% Supermarket Revenue Increase in Q1

Private label products are gaining traction, comprising 25.4% of shopping basket shares, up from 24.7%

![Σούπερ μάρκετ: Πώς μπορείτε να συγκρίνετε τις τιμές για 3.000 προϊόντα [πίνακες]](https://www.ot.gr/wp-content/uploads/2024/04/super-market1-1-600x389.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433