The hot money of private equity and the Recovery Fund, the need for many companies to strengthen their capital base for growth and exports, the tendency to create “national champions”, the resurgence of the economy and the prospects of the sector of Greek agri-food, reshape the landscape in the domestic industry and the organized retail of the food and beverage sector.

2022 will offer just as many thrills as 2021, say financial analysts and market participants, stressing that significant deals, including acquisitions and mergers, have already been launched in the two main branches of the food and beverage market.

The interest of the Greek and foreign capital for recognizable Greek brands from the food industry has not diminished from the crisis of the pandemic and already several smaller and larger companies, which have growth prospects, are in the spotlight.

After all, 2021 was a record year for the acquisitions in the food and beverage sector, with the sale of Chipita to Mondelez, for a total price of 2 billion dollars, the second largest acquisition in the year ending after the deal of the sale of HEDNO to Macquarie, to raise the bar to the heavens.

In 2022, the investment movements of the funds are expected to be more than in 2021, while it is estimated that in the sector of acquisitions, the activity of strong Greek entrepreneurs will be important.

Fotakidis, Theodoropoulos, Kikizas and billionaire Taizoon Khorakiwal

The acquisition of Vivartia, which exceeded 630 million euros, the acquisition of the majority stake in the Dodoni dairy industry and the transfer of shares of Hellenic Dough and Alesis to Barba Stathis, which was completed recently, will not be the only moves by CVC Capital Partners‘s unique moves in the field of food as well-informed sources note. Besides, Alex Fotakidis, partner and representative of the American fund, has announced more investments in our country for the next 4 years.

At the same time, the new food group of Spyros Theodoropoulos, after its divestment from Chipita, apart from the Nikas meat industry and its entry in Mevgal with a percentage of 21.5%, is said to be in negotiations with another company from the wider food sector.

Read also: Theodoropoulos (Chipita) – Sees large price increases starting January

An Indian businessman from the Switz Group also has aspirations to expand his Greek businesses. Billionaire Taizoon Khorakiwal after Olympic Foods, CSM Hellas Bakery Solution, Cretan Bread and recently “Koulourades” and the home confectionery company Samouri, is close to other acquisitions, always in the food industry.

It is estimated that the intention of the Melissa Kikizas company to transform “into a group that will offer the best products of the Greek diet, worldwide” will not be exhausted in the recent acquisition of the olive oil company Terra Creta by the IOGR group of Giannis Grylos. In the recent past, Melissa Kikizas had contested Minerva Oleourgiki, without being able to acquire it.

The choices of Greek funds

The food and beverage sector seems to be very high on the list of investment funds of Greek funds.

Elikonos 2 S.C.A. SICAR (Takis Solomos-Pantelis Papageorgiou) recently announced the acquisition of a minority stake in Select Fish SA.

Select Fish is active in the field of fish processing and packaging and is the largest distributor of salmon on the domestic market. It was preceded by the acquisition of a minority participation in the Great Greek Traditional Tour SA.

Elikonos 2 S.C.A. SICAR together with EOS Capital Partners, led by Apostolos Tamvakakis, have co-invested in Eurocatering (Freskoulis).

The investment fund of Dimitris Daskalopoulos through Minerva Eleourgiki completed in 2021 two major acquisitions. It was preceded by that of Pummaro by Unilever in March 2021, while at the end of July followed the acquisition of Mediterranean Foods by businessman Apostolos Salakos (known for the Brava and Delicia brands).

The company Minerva was acquired in September 2019 by the company Elea Zeus SA The latter is controlled by the investment fund Diorama Investments Sicar SA, which was founded in Luxembourg by the former president of Hellenic Federation of Enterprises SEV, Dimitris Daskalopoulos. The fund’s investment manager is Deca Investments. The investment fund Ellikonos 2 SCA Sicar and the fund EOS Capital also participate in Elea Zeus.

The food industry continues to be on the radar of VNK Capital, as the goal is to enter the domestic retail μαρκετ through acquisition. Today VNK Capital has holdings in, among others, the companies Palirroia and Cafetex.

SMERemediumCap (SMERC) also appears to be close to acquiring a rice and legume company. It was preceded by the acquisition of the company Krop based in Arta, which is active in the production and export of fruit. According to the executive president of SMERC, Mr. Nikos Karamouzis, the investment fund wants to proceed with targeted acquisitions of small and medium-sized Greek companies with a turnover of 10 to 80 million euros that need a strategic investment to grow and adapt to new conditions.

The other deals in food

The recent acquisition by the Achaean Lux soft drinks industry of 42.34% of the Dirfys bottling company with a price reaching 1.2 million euros came a few weeks after the announcement of the acquisition by N.U. Aqua of the water bottling plant of Pepsico Hellas in Loutraki, Corinth.

The moves of Lux and N.U. Aqua were not the only ones in 2021 in the bottled water sector, as a few months ago, in mid-May, the Hitos family (water Zagori) from Giannio, one of the protagonists of the sector, had acquired the company Ziria, located in Kyllini, Stymfalia, in Corinth, acquiring a source and water bottling unit in the area.

Also, just before the end of 2021, the frozen company G. Kallimanis, with 90% of its loans “cut”, passed to the Turkish fishing industry Dardanel entnentaş. The discussion of the consolidation plan is scheduled for the Court of First Instance of Aigio on January 18.

Acquisitions in quick commerce

The acquisition of the 4 companies of the Mouchakis group, namely kiosky’s, Alfa distributions, delivery.gr and e-table, by the German multinational online food delivery company Delivery Hero, will not be the only one in the emerging sector of electronic food sales, say market executives.

Delivery Hero currently has a leading presence in quick commerce, as it has efood, InstaShop and the acquired companies of the Mouchalis group.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

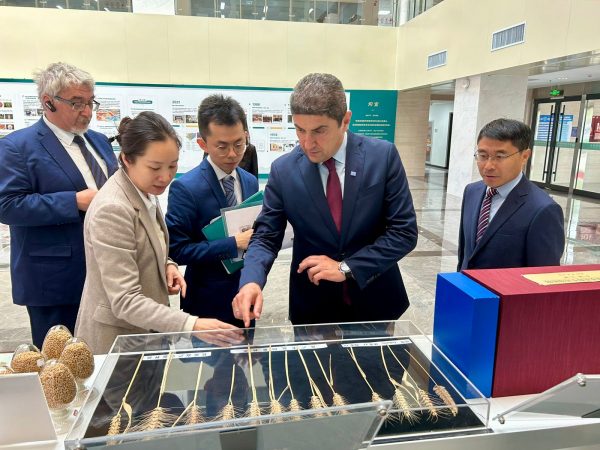

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433