In the very narrow zone of 900 – 910 units the Greek stock market remains for the fifth consecutive session. This although creating an air of a few units above the psychological limit of 900 units, can not move decisively higher. Thus, with the limited + 0.45%, it remains at 905.24 points, where it has found the balances with the sellers.

What worries analysts, however, is that while the overall index, since the beginning of the month, has climbed… ten points on the recovery ladder, with a good record of 50 points so far, this has happened with low turnover. In fact, if you deduct pre-agreed transactions and transactions related to the increase of PPC’s capital, then serious questions are raised about the foundations of the positions created.

So the real picture will be seen in the near future, or in any case if the turmoil returns to international markets. Traditionally, November is a month in which foreign portfolios (over 60% on the ATHEX) complete their 12-month strategies and choose positions for next year. Whether the bet of staying on Athens Avenue will be won, therefore, is an important message that the ATHEX should give.

In such a context and just two meetings away from the end of October, Jumbo supports the market with + 2.26%, as do Sarantis, OPAP and HELEX. The presences of Eurobank, Mytilineos, Coca Cola, PPC, National Bank and Alpha Bank are also positive, while on the other hand, the losses in Motor Oil, Biochalco, Hellenic Petroleum and Titan have a negative effect.

Latest News

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

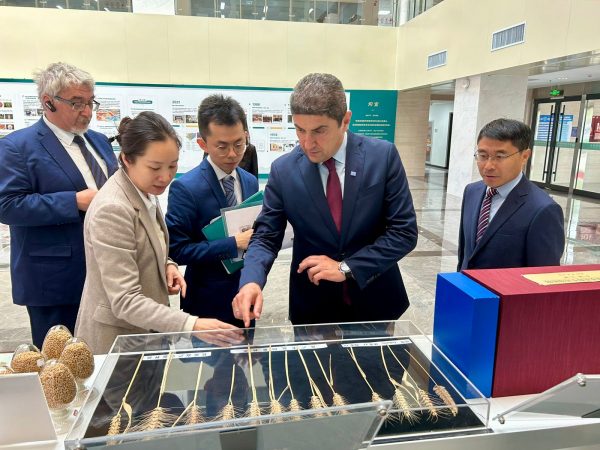

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Greek PM Mitsotakis Says Fight Against Inflation Ongoing

The Premier made statement during a visit an an open vegetable market

Unpaid Taxes in Greece Reach 1.539bln Euros

As the figures revealed the number of debtors totaled 3,878,712 individuals and legal entities.

ELSTAT: Greek Primary Surplus Reaches 1.9% of GDP in 2023

Greek debt saw a slight dip to 356.7 billion euros by the end of 2023, down from 356.8 billion euros a year prior

![Φυσικό αέριο: Γιατί είναι δύσκολη η απεξάρτηση από τη Ρωσία – Τα εμπόδια [Χάρτης]](https://www.ot.gr/wp-content/uploads/2022/07/gas-1-1-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433