The primary deficit in the period January-December 2021 is about € 2 billion better than the target estimates.

According to the provisional execution data of the state budget, there is a deficit in the state budget balance of € 15,529 million against a target for a deficit of 17,487 million euros that has been included for the corresponding period of 2021 in the budget report 2022 and a deficit of 22,806. The primary result was a deficit of € 10,985 million, compared to a target for a primary deficit of € 12,946 million and a primary deficit of € 18,195 million for the same period in 2020.

“A better deficit”

According to a statement by the Deputy Minister of Finance, Theodoros Skylakakis, the execution data of the twelve-month budget show a significantly better deficit for 2021, compared to the one entered in the 2022 budget. At the central government level, the state budget deficit is about two billion smaller (€ 1965 million). These data are temporary and we will have to wait, before reaching final conclusions, for the finalization of the relevant data for which the disclosure of both the general government data and the tax revenues for the first two months of 2022 that are part of the 2021 budget. (VAT, ENFIA, income tax, traffic fees, etc.) is required. It is noted, however, that much better execution has been achieved, despite the fact that the payment of road taxes has been suspended for two months.

The investment grade

However, this development is in any case important for the fiscal credibility of the Greek state, which is a central goal of the government in the context of the country’s effort to gain the investment grade.

The net revenue of the state budget amounted to € 54,220 million, showing an increase of € 800 million or 1.5% compared to the estimate for the corresponding period included in the budget report 2022. This increase was mainly due to the fact that in December an amount of € 644 million was received regarding revenues from ANFAs, which were not foreseen for 2021 in the presentation report of the Budget 2022, while, on the other hand, due to the extension of the deadline for traffic fees until the end of February 2022. It is estimated that a significant amount foreseen to be collected in the year 2021 will be finally collected in 2022.

Total revenue

Total state budget revenues amounted to € 59,324 million, an increase of € 1,244 million or 2.1% against the target.

Tax revenue amounted to € 47,602 million, up € 743 million or 1.6% from the target set out in the 2022 Budget report. However, if we take into account the extension of the collection of road taxes, the real increase in tax revenues is even greater.

The exact distribution between the categories of revenues of the state budget will be made with the issuance of the final bulletin.

Revenue recoveries amounted to € 5,104 million, up € 443 million from the target (€ 4,660 million).

Public Investment Budget (PDB) revenues amounted to € 4,519 million, down € 275 million from the target (€ 4,793 million).

Net income

In particular, in December 2021 the total net revenue of the state budget amounted to € 5,744 million, increased by € 474 million compared to the updated monthly target. As mentioned above, the revenue for December includes an amount of € 644 million from ANFAs, which was not foreseen to be collected, while it is estimated that a significant amount was not collected due to the extension of the deadline for payment of traffic fees, which was foreseen to be collected in December.

The total state budget revenues amounted to € 6,578 million, increased against the monthly target by 835 million euros.

Revenues from taxes amounted to € 4,670 million, reduced by € 41 million or 0.9% against the monthly target, mainly due to the extension of the deadline for payment of traffic fees until the end of February 2022.

Revenue returns for December 2021 amounted to € 833 million, up € 361 million from the target (€ 472 million).

Revenues of the Public Investment Budget (PIP) amounted to 751 million euros, an increase of € 145 million from the target (€ 606 million).

Costs

The State Budget expenditures for the period January – December 2021 amounted to € 69,750 million and are reduced by 1,157 million euros or 1.6% compared to the target (70,907 million euros), which is included in the budget report 2022.

In the part of the Regular Budget, there is a lag against the target by € 1,208 million or 1.9%, which is mainly due to the under-execution of other grants by € 781 million. The aforementioned under-execution is mainly a result of the collateral assessment for dealing with the pandemic, for the year 2021.

Payments

Payments on investment expenditure amounted to € 9,001 million showing an increase compared to the target of € 8,950 million by € 51 million or 0.6%.

The provisional picture of the main payments of the measures against the pandemic for the period January – December, is as follows:

(a) the cost of special purpose compensation due to the COVID-19 (employee) pandemic of € 2,017 million, paid by the Ministry of Labor and Social Affairs (transfer category);

(b) a repayable advance of € 1,620 million from the category of transfers and € 1,108 million from the EDP;

c) the state compensation of landlords amounting to € 744 million, due to reduced rents they receive;

d) the grant to OPEC amounting to €227 million , for the repayment of loans affected by the pandemic;

(e) the support of small and micro-enterprises affected by COVID-19 in the Regions amounting to € 741 million from the EDP;

f) the subsidy of interest on loans to small and medium-sized enterprises amounting to € 117 million from the EDP;

(g) expenditure on the business guarantee fund of € 220 million from the EDP;

(h) the working capital subsidy to catering establishments for the supply of raw materials amounting to € 243 million from the EDP;

i) the public contribution for the repayment of business loans of affected borrowers amounting to € 259 million from the EDP;

j) the working capital subsidy to tourism enterprises amounting to € 195 million from the EDP;

k) the coverage of insurance contributions to e-EFKA during the implementation of the measures of support of employers and employees amounting to € 703 million from the category of transfers;

l) the coverage of insurance contributions to e-EFKA related to the subsidy of fixed costs of enterprises amounting to € 243 million;

m) the extraordinary subsidy of the Municipalities for the confrontation of the pandemic amounting to € 101 million,

n) the grant to OAED to cover a loss of revenue of € 571 million,

(o) the grant to the EOPYY for the response to the public health emergency, in the framework of the measures against the pandemic amounting to € 108 million; and

p) the grant to various social security organizations to cover the insurance contributions of new subsidized jobs amounting to € 107 million.

The state budget expenditures for the period January – December 2021 are reduced compared to the corresponding period of 2020 by € 420 million.

Latest News

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

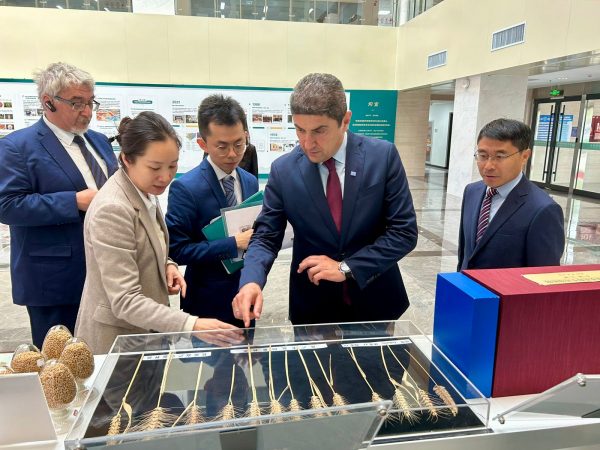

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Greek PM Mitsotakis Says Fight Against Inflation Ongoing

The Premier made statement during a visit an an open vegetable market

Unpaid Taxes in Greece Reach 1.539bln Euros

As the figures revealed the number of debtors totaled 3,878,712 individuals and legal entities.

ELSTAT: Greek Primary Surplus Reaches 1.9% of GDP in 2023

Greek debt saw a slight dip to 356.7 billion euros by the end of 2023, down from 356.8 billion euros a year prior

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433