The Greek economy’s prospects remain encouraging, despite inflationary pressure that has significant increased due to the recent Russian invasion of Ukraine, National Bank of Greece CEO Pavlos Mylonas opined this week.

In a message accompanied the group’s results for 2021, where net profits for the year increased by 41 percent, or 833 million euros in absolute terms, Mylonas said the Greek economy’s fundamental figures are strong, even amid the currently negative international conditions.

The NBG group CEO added that the country’s economy will post a significant GDP growth in 2022, and even higher growth in 2023 and 2024.

Turning to the domestic bank itself, Mylonas said the top goals are reducing NPEs to under 3 percent of NBG’s total portfolio and increasing the tangible performance of equity to double-digit figures.

Mylonas’ entire statement reads:

“Results from NBG’s multi-year transformation effort are more evident than ever in 2021. Capitalizing on Greece’s strong economic recovery, we have delivered strong organic profitability, an ambitious NPE clean-up and a growing and well-capitalized balance sheet, underpinned by the rapid change towards a more flexible and efficient operating model. Starting with asset quality, the stock of domestic NPEs declined to €2.1b and the net NPE exposure to only €0.5b. The NPE ratio in Greece dropped to 6.9%, down by 7 percentage points in a year, bringing us to just short of the 6% FY22 NPE target, one year ahead of schedule. At the same time, despite a steady normalization of our CoR throughout 2021 to 68bps in 4Q21, our domestic cash coverage increased to 78% arising from the favorable underlying organic NPE formation trends comprising sustained organic curing and few new defaults (including from expired moratoria). On the profitability front, Group PAT from continued operations reached €833m, on strong operating P&L trends. More importantly, core operating profit surged by c40% yoy to €450m, ahead of guidance, reflecting improvement in core income, extensive cost cutting and CoR normalization, boding well for achieving our FY22 Group COP target of €0.5b. Decisive cost cutting, with personnel expenses down by 12% yoy and NII resilience, up by 3% yoy, are the key contributors to profitability improvement. The latter is supported by a €1.4b yoy expansion of our PE loan book. Finally, with regards to our capital strength, CET1 increased by c120bps to 16.9% and total capital to 17.5%, benefiting from a highly capital accretive Frontier transaction and strong profitability.

The completion of Ethniki Insurance sale and the strategic partnership with Evo Payments, with the former expected to close within the next few weeks and the latter in 4Q22, will add to our total capital ratio c160bps, creating strategically significant capital buffers. Looking ahead into 2022 and beyond, the prospects of the Greek economy are very positive, despite the inflation[1]related headwinds that have been bolstered significantly further by the Russian invasion of Ukraine. The fundamentals of the economy are strong and even with the current global environment, Greece should experience respectable positive output growth in 2022 and much better outcomes in 2023 and 2024. Thus, NBG’s performance targets remain ambitious. Specifically, we aspire to quickly close the remaining distance to c3% European level NPE ratio and continue to improve the pace of organic capital generation, both through further top line improvement as well as operating cost efficiencies and CoR normalization.

The target is to achieve a double-digit RoTE ratio. Improved profitability and our strong capital ratios should allow us to commence a policy of prudent dividend distribution in the near term. Meeting these ambitious objectives requires significant further effort in a world experiencing rapid technological change and more exacting customer expectations. Our Transformation Program will continue to provide NBG with a competitive advantage in driving this necessary change. Our investment in technology and people are the critical components to successfully achieving our targets and be the Bank of First Choice. The results so far, and especially in 2021, affirm our capacity and dedication to deliver these goals.”

Latest News

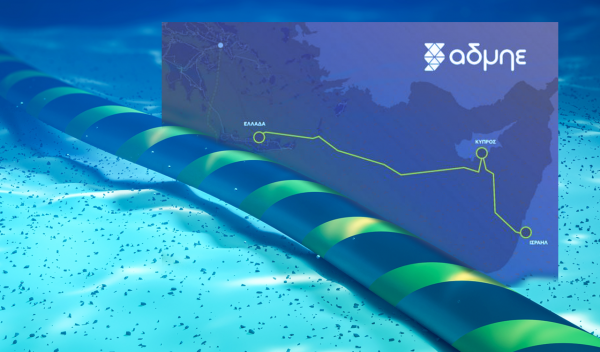

French Fund Meridiam Shows Growing Interest in Great Sea Interconnector

According to OT, the fund engaged in recent discussions regarding the Great Sea Interconnector with Greece’s Minister of Environment and Energy and the CEO of Greece’s Independent Power Transmission Operator (IPTO/ADMIE)

Everything to Know about Store Hours this Holiday Season

Stores and supermarkets across the country are operating extended hours, offering ample opportunities for holiday shopping

Greece Prepares for State Budget Vote as Debate Reaches Final Stages

Prime Minister Kyriakos Mitsotakis is expected to deliver his remarks late in the evening, shortly before the decisive vote that will conclude the session

DM Dendias: We talk With Turkey But We Always Bring Up Their Unacceptable Positions

Second and last day of closely watched conference, entitled 'Metapolitefsi 1974-2024: 50 Years of Greek Foreign Policy', also included appearances by PM Mitsotakis, Ex-PM Tsipras and PASOK leader Nikos Androulakis, among others

Rhodes Airport Tops Fraport Greece’s Regional Airports in 2024 Performance

According to Fraport's data, more than 35 million passengers (specifically 35.2 million) were handled by Fraport-managed airports during the 11 months.

European Central Bank Cuts Interest Rates by 25 Basis Points

It is the fourth cut of interest rates by Europe’s central bank, a move expected by the markets and financial analysts leading to the rate settling at 3%.

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

![Φυσικό αέριο: Δυναμικό come back του LNG στην Ελλάδα [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/01/OT_naturalgas-90x90.jpeg)

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433