E-commerce of food and groceries has come to stay and although turnover is declining, as inflation is in double digits and consumers are cutting back to make ends meet, supermarket chain investments in e-commerce channel continue.

The big bet for the small and not yet profitable electronic basket, is the speed of order delivery, since the digital competitors of traditional retailers, the electronic platforms of ordering and distribution, promise deliveries of groceries in lightning times: from 15 minutes to one hour.

Sklavenitis’ new dark stores

In this direction, the leader of the industry, Sklavenitis, is drastically reducing the delivery times in Attica, launching the new ehub (storage center for the service of electronic orders) in Kato Kifissia, covering the northeastern suburbs and the surrounding areas.

This is the fourth and largest “dark store” of the group in Attica, which, according to information available to OT, has the ability to serve about 2,000 electronic orders per day. Thus, the delivery time, which had reached up to 6 days in Attica, now “goes down” to a few hours.

In organized retail, chains competing with Sklavenitis have managed to deliver orders even within the same day, something that the industry leader had so far only managed for orders through the efood platform, but where the 10,000 products on its eMarket online store are not available..

It must be noted that, in addition to the new e-hub in Kifissia, in order to serve the electronic orders of eMarket, the chain has another state-of-the-art e-hub in Petrou Ralli Avenue, one in Gerakas, Eastern Attica and one in Pylaia, Thessaloniki, while in Patras and Larissa where group has expanded its online store digital orders are served through local hypermarkets.

Sources close to the chain state that Sklavenitis’s strategic planning for the further development of its online store includes the creation of new e-hubs for the better and more immediate service of its customers, but also the further strengthening of the eMarket both through the expansion of the available categories and products, as well as through its expansion into new areas.

As for the course of sales of the online store, which was launched in November 2020, the information of the Financial Post states that they are moving in line with the forecasts of the company, achieving consistent performance.

Masoutis, AB Vassilopoulos and Wolt Market are expanding

At the same time, the creation of a dark store in Athens has been launched by Masoutis, which is located in the area of Metamorfosi, while others will follow, according to what the chain claims.

Also, the Wolt Market, which is proceeding with its autonomous expansion, in parallel and independently with the Wolt food distribution platform, today has 5 dark stores in Athens, 2 in Thessaloniki and 1 in Patras, while another will be opened in Nea Ionia, in order to meet the needs in the northwestern suburbs.

At the same time, within the next two years, AB Vassilopoulos is planning two new wahrehouse centers in Attica and Thessaloniki, respectively in line with what it has in the area of Rentis, to serve its online store.

Reduced electronic basket

2022 for the online supermarket shopping sector starts with -4% compared to last year and the course of the industry is expected to be particularly interesting for the remaining 9 months, according to Convert Group.

In the first quarter of this year, the value of the e-cart reached 61 million euros, while the 2021 it reached 255 million euros from 45 million in 2019. It is noted that the Convert Group sample includes a total of 7 of the 9 key players and all delivery platforms that work with online super markets representing 88% of the market.

The categories that increased in value (in euros) of online shopping in the months of January, February and March of 2022 compared to the corresponding period of 2021, stand out as follows: + 11% in pet products, + 3% in care products and baby food and children items and + 2% on stationery and cleaning supplies. In addition, the fresh food category accounted for 34% of the industry’s annual sales.

Regarding the average value of the shopping cart, there is a stabilization in the first quarter of 2022 at 78 euros including VAT, which is approximately at the same levels as in the corresponding quarter of 2021. On the contrary, there is a 4% decrease in the number of products included in online orders.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

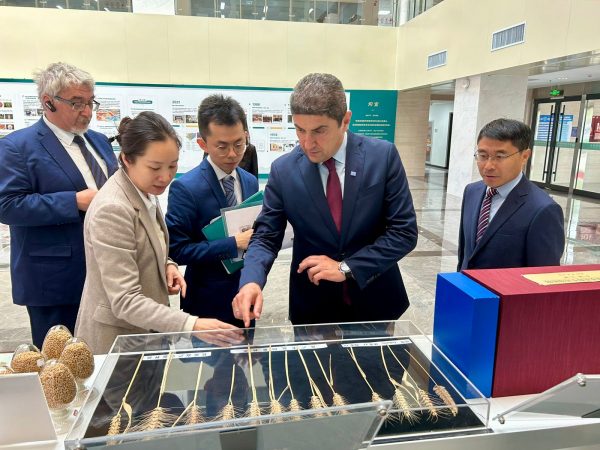

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433