The Greek stock market is currently trying to limit the fall, but with weak supports from selected securities, the general index cannot climb back to the zone of 890 units. The general index recorded losses of 0.55% at 886.53 points, with the turnover at 26 million euros.

Climate

Sellers are gradually gnawing away the gains of the last two months on ATHEX, as they in turn are influenced by the international wave of “risk off” that has been triggered by uncertainty about the intentions of central banks, and whether the effort to reduce the money supply will affect economies. Of course, UBS today came to confirm that the growth rate of the Greek economy will remain strong, even higher than the initial estimate.

Eyes on Wall Street

The correlation of the last several months with international markets dictates that eyes are always there, and especially on Wall Street, where things are very fluid both in the medium term, with the Federal Reserve’s shifting and aggressive monetary policy, as well as and in the very short term, with the announcements from Jackson Hole being awaited with great interest, mainly in terms of the Fed’s wording and intentions, Trader24 reports. So far, no new data has been added to the existing analysis, which wants the general index moving bullishly in the short-term, with the area of 917-920 units being a serious resistance, while the base support is seen at 878.

Traded shares

On the level of shares, Piraeus, Alpha Bank, Eurobank, National Bank, Viohalco and Quest are experiencing strong losses, while the decline in ADMIE, Aegean, PPC, Ellactor,Jumbo, Lambda, Titan, ELHA, PPA, Sarantis, Coca Cola, and Motor Oil is also significant. On the other hand, Terna Energy gains 1.62%, with EYDAP, GEK Terna, OTE, OTE and Mytilineo also making small gains.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

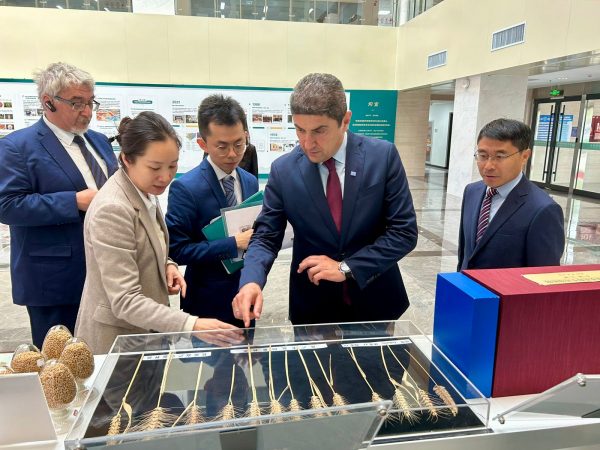

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433