Τhe invitation addressed by the government to workers and professionals abroad to move to Greece for tax purposes goes along with a “haircut” of 50% of income tax and the special solidarity contribution, for seven years, and complete exemption from the presumption (on maintenance costs and acquisition of assets) of residence or car. The Ministry of Finance, using low taxation as an incentive, is trying to convince Greeks, especially young people and scientists, who emigrated during the years of economic crisis and the Memoranda, to return to their country.

The decision signed by the Deputy Minister of Finance Apostolos Vesyropoulos and the Governor of AADE, George Pitsilis, determines the terms and conditions of the tax invitation. Particularly:

1. Those who decide to transfer their tax residence to Greece must submit an application by September 30, 2021.

2. A natural person who transfers his tax residence to Greece is subject to the reduced tax regime if cumulatively:

a) was not a tax resident of Greece for the previous five of the six years prior to the transfer of his tax residence to Greece;

b) transfers his tax residence from an EU Member State. or a state of the European Free Trade Association or a state with which an administrative cooperation agreement in the field of taxation with Greece is in force,

c) provides services in Greece in the context of an employment relationship exercised either with a domestic legal entity or the legal entity of a foreign company with a permanent establishment in Greece; and

d) declares that he will remain in Greece for at least two years.

3. Especially for the applications for inclusion in the special way of taxation from paid work and business activity that arises in the country, which will be submitted within the year 2021 and concern the assumption of service or start-up of a sole proprietorship until July 31, 2021, the deadline for submission of the relevant application and accompanying supporting documents is set until 30 September 2021.

4. The applications are examined by the Tax Office for Residents Abroad and Alternative Taxation of Domestic Tax Residents. The decision is issued by November 30, 2021.

5. Applications submitted after 30-9-2021, are accepted and examined in order to include the taxpayer in the special taxation of income from paid work and business activity that arises in the country for the next tax year.

6. Individuals who have already transferred their tax residence to Greece and have concluded employment contracts or have started work within the tax year 2020 can apply for inclusion in the special taxation method from paid work and business activity that arises in the country if they were not tax residents of Greece in the years 2015 to 2019. For these persons, if they have undertaken paid work or have started work before the law that was passed (4-12-2020), the employment contract does not have to be accompanied by the responsible declaration of the employer For the specific individuals, even if they took a job in the tax year 2020, their inclusion in the special tax method will begin for the income obtained from 1-1-2021 onwards, and the person’s intention to stay in Greece for two years starting from 1-1 -2021 must be stated, through a responsible declaration is required.

7. Applications shall be accepted even if they are not accompanied by the original relevant supporting documents at the time of their submission, provided that a responsible declaration is submitted by which the taxpayer declares that he meets the conditions and that he is unable to submit them in the prescribed manner, and in international legally, due to the fact that the respective services are suspended or limited in their operation due to the consequences of the COVID-19 pandemic. The taxpayer is obliged to submit the supporting documents, in order to complete his file, in a reasonable time and no later than November 22, 2021.

8. Those who meet the criteria and transfer their tax residence to Greece will pay half the income tax for a period of seven years.These favorable provisions may not be extended beyond seven tax years.

9. Natural persons subject to the favorable regime are excluded from the presumption of residence or passenger car for private use.

Latest News

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

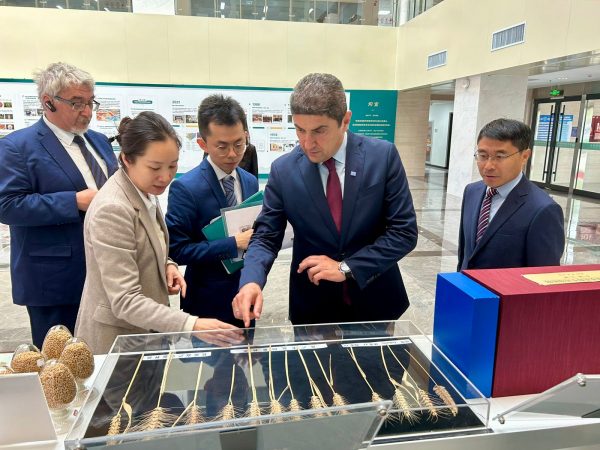

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Greek PM Mitsotakis Says Fight Against Inflation Ongoing

The Premier made statement during a visit an an open vegetable market

Unpaid Taxes in Greece Reach 1.539bln Euros

As the figures revealed the number of debtors totaled 3,878,712 individuals and legal entities.

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433