The ECB has remained firm in its intention not to change course in its monetary policy despite the escalation of inflationary pressures. Yesterday the statistics showed a jump in inflation in the Eurozone to 5.1% in January, against estimates for its decline to 4.4%.

The governing council therefore stated that it is ready to properly adjust all the means at its disposal in order to ensure that inflation will stabilize at the 2% target in the medium term. For now, however, this does not translate into a change in interest rate policy.

Specifically, the announcement states that “the interest rate of the main refinancing operations as well as the interest rates of the marginal financing facility and the deposit acceptance facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively.

To support its symmetric 2% inflation target and in line with its monetary policy strategy, the Governing Council expects the ECB’s key interest rates to remain at current or lower levels until it finds that inflation is very high at 2%. before the end of the projection horizon under consideration and lasting for the remainder of the projection horizon, and considers that the course of the underlying inflation has progressed sufficiently to be compatible with stabilizing inflation at 2% in the medium term. “This may also mean a transitional period in which inflation is moderately above the target.”

Regarding the emergency bond buying program, PEPP reiterated its commitment that this will continue, but will stop, at the end of March.

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

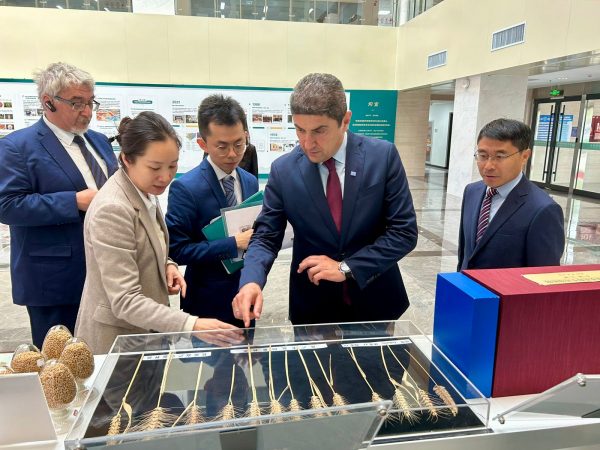

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433