In a key period for the developments in the outstanding pensions, during the second half of the year, as, on the one side, the expected explosive increase of the new pension applications – will affect the number of existing pending – on the other side, this period will serve as a test for the effectiveness of the “Government plan” to solve the problem of delays in the granting of pensions, by recruiting private liquidators.

Already in the first half of this year (January-June) 83,905 new retirement applications were submitted, compared to 73,049 applications in the corresponding period last year. In fact, in 2019, the year in which there was an explosion of pensions, in the first half of the year the applications had reached 79,887.

2021 is the last year of the transitional provisions which increase – gradually – the retirement age for the “old insured” in special funds. From 2022, the limits of all are adjusted to the 62nd year of age and the 40 years of insurance or the 67th year of age with 15 years of insurance.

Fearing the submission of a lot of pensions, the Ministry of Labor has – in recent days – assured that there will be “no change in th retirement age” and therefore there is no reason to rush.

“Those insured who have estiblished the right within 2021, they can exercise it at any time without any restrictions”, the Ministry of Labor emphasizes, in order to reassure the insured who – fearing reversals in the insurance regime – rush to apply for retirement in order to maintain the existing more favorable regime.

Therefore, those insured who have established or secured a right to retire by 31/12/2021, there is no reason to rush to retire at the end of the year, as they can do so whenever they see fit. In this way, they will not be deprived of the increased return they will receive for each year they will stay extra in their work.

The current retirement regime

In detail, the regime that is in force now and will remain in force provides the following:

Those insured who established a right to retirement until 18/08/2015 can submit their retirement application at any time – and after 01/01/2022 – without any restrictions or increase in retirement limits.

Example: An insured mother of a minor who until 5/31/2012 had 5,500 days of insurance and was 57 years old, can retire at any time, after establishing the right before 8/18/2015.

Those insured who secure the right to retire between 19/8/2015 to 31/12/2021 can also exercise their right at any time, – and after 1/1/2022 – and specifically when they complete the new (transitional) age limit.

Example ( guarantee of the right until 31.12.2021, exercise of the right after 01.01.2022): Insured mother in the Social Insurance Institute who, in 2012, has completed 5,500 days of insurance, also has a minor child, and completes the 60th year of age, in 2019, is entitled to a full pension upon reaching the age of 64 and 5 months. She guarantees this right in 2019 and she establishes it in 2023. This right is not lost and can be exercised after 2023.

Insured persons who did not establish or secure a pension right before 31/12/2021, do not fall under the transitional age limits and retire from 01/01/2022 with the following basic rules:

In the 67th year of age, with at least fifteen (15) years of insurance or four thousand five hundred (4,500) days of insurance.

At the age of 62, with at least forty (40) years of insurance or twelve thousand (12,000) days of insurance.

At the age of 62 and the respective insurance days required for a reduced pension, where this is provided.

More specific provisions continue to apply to specific categories of insured (military, heavy and unhealthy, etc.)

Latest News

Athens Int’l Airport Wins Top Prize at Routes Europe Awards

The Routes business is focused entirely on aviation route development and the company's portfolio includes events, media and online businesses

IOBE: Income Gap Between Poor and Wealthy Greeks Widens

The findings in the analysis, entitled “Progressivity in Income Taxation in Greece, 2012-2021", paint a bleak picture for Greeks in the bottom half of the income bracket, warning that income inequality is growing

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

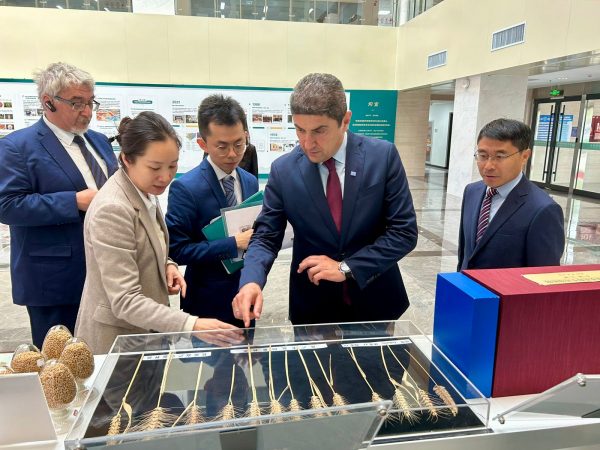

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433