Banks are gradually shaping their new role, with the aim of boosting their revenues, which is a necessary condition for a return to viable and sustainable profitability.

Interest on loans may continue to be the main source of revenue for the industry, but they are not enough in the new, more complex and competitive financial environment.

In this context, a dominant position in their business plans is to increase their commission revenue. The first steps in this direction have already been reflected in the figures of the last quarters.

However, this is only the beginning. In the coming years, the four systemic groups are called upon to close the gap with the rest of Europe on this front.

According to recent data from the European Central Bank (ECB), the ratio of commission income to the total income of domestic banks is below 15% compared to more than 30% in the EU.

The strategy

Covering this distance, in addition to the increased commissions from the acceleration of credit expansion, necessarily goes through the provision of third party services through their networks, both physical and digital. In other words, they will cease to be vertical units.

It is something that is already happening on a large scale with the sale of bank insurance products to their customers, such as hospital plans, life products and damage insurance for vehicles and houses.

What is required at this stage, however, is a change in the way customers are approached. In particular, banks will not sell products, but will cover all kinds of needs.

“Instead of the client coming and asking us for a mortgage, he will come and tell us ‘I want to get a new home’. And we will be there to meet the specific need from A to Z”, emphasizes a banking source.

As he typically says, banks in cooperation with realtors and real estate companies will find for their client a series of options in the real estate market, which on the one hand will meet his wishes and on the other hand can be financed, based on his credit profile. Something similar can be done with the purchase of a car.

Integrated business support

On the other hand, business and professional loyalty presents significant revenue generating opportunities. Systemic groups have already created a service ecosystem, which will be continuously enriched, in collaboration with companies from a variety of industries.

In this way, they help their customers, especially small and medium-sized businesses, to modernize, better organize, digitize and become greener, under the guidance of their banking advisors.

Typical examples are the transition to the cloud, the computerization of accounting, the creation of e-shops and digital marketing to promote e-sales.

In this way everyone is won. On the one hand, the banks that receive commissions from the cooperating companies and on the other hand, their customers who meet their needs with better prices.

The same applies to development programs, such as the actions of the Recovery Fund and the NSRF. The banks present to their customers all their options and then their implementation is done by their specialized partners.

In this way, both the planning of investment actions and the provision of the necessary resources for their implementation are supported.

Latest News

Study Finds 4 in 10 Greeks to Slash Easter Spending

This year, hit by persistent inflation, many Greeks will be dishing out less on food, drink and gifts for Orthodox Easter on May 5

ELSTAT: Overnight Stays in Greece Up in Feb.

The provisional monthly data revealed that arrivals at tourist accommodations amounted to 773,104 and overnight stays were 1,677,685

Electric Energy: Greece’s New Sustainable Export

Moreover, a surplus of generated electricity cannot be fully absorbed by domestic grids and this excess power finds eager buyers in the form of companies entering into Power Purchase Agreements (PPAs), willing to pay a premium for clean energy

IOBE Revises Greek GDP Growth Downward, to 2.1% For 2024

Annual inflation is expected to reach 3%, up from the previous forecast of 2.8%

Last Sections of 136km E65 Highway Inaugurated on Tues.

Athens to Karditsa drive time is expected to drop to two and a half hours (under normal conditions), and some three hours from Athens to Trikala

Reuters: Greece to Repay More Bailout Loans Ahead of Maturity in 2023

The country has relied solely on international markets for its borrowing needs since a third institutional bailout ended in 2018

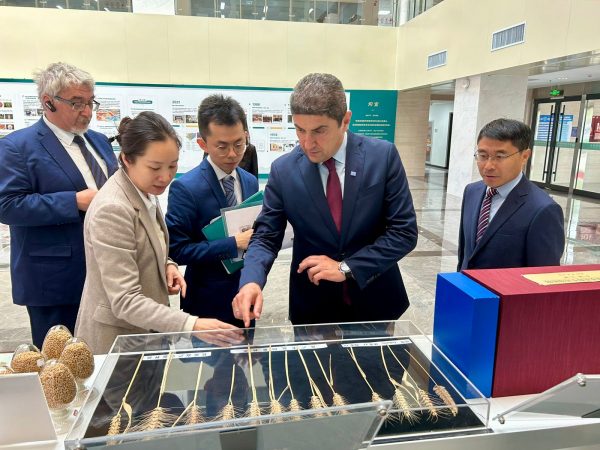

Ag Min. Avgenakis: Greece-China Cooperation in Research, Education in Agri-Food Sector

Greek minister tours cutting-edge hydroponics and robotics facilities at the Chinese Academy of Agricultural Sciences in Beijing

Mini Holiday Season in Greece for Upcoming Orthodox Easter

Occupancy rates reach up to 90% domestically for accommodations open ahead of peak summer season

Greek PM Mitsotakis Says Fight Against Inflation Ongoing

The Premier made statement during a visit an an open vegetable market

Unpaid Taxes in Greece Reach 1.539bln Euros

As the figures revealed the number of debtors totaled 3,878,712 individuals and legal entities.

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433